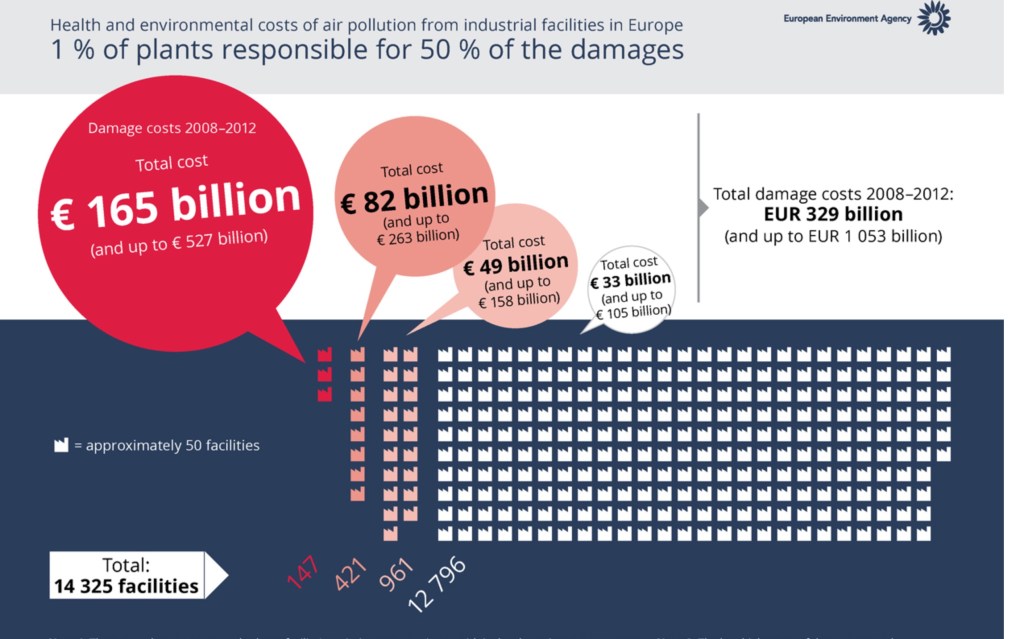

We all have moments where we look at the sky and roll our eyes. Today was my moment when I was treated (by the Guardian) to ‘Big oil and gas kept a dirty secret for decades. Now they may pay the price’, in this I start with “Was it really a secret?” You see, we all want to blame someone else for the problems we helped create. And when the (what I reverently call) the stupid people are bringing about “An unprecedented wave of lawsuits, filed by cities and states across the US, aim to hold the oil and gas industry to account for the environmental devastation caused by fossil fuels – and covering up what they knew along the way”. You see that is is merely one element of stupid. I gave light to ‘Uniform Nameless Entitlement Perforation’ on December 10th 2020 (at https://lawlordtobe.com/2020/12/10/uniform-nameless-entitlement-perforation/), I emphasised on a report by European Environmental Agency (EEA) where. We see that 147 industrial plants create 50% of the pollution, the media seemingly ignored the report I have not see the media go out and bash the nations for these 147 plants, we even had a joke (read: BBC article) by Tim McGrath on how the “Global ‘elite’ will need to slash high-carbon lifestyles”, so how stupid do people need to get?

This reflects on the now when we see (at https://www.theguardian.com/environment/2021/jun/30/climate-crimes-oil-and-gas-environment) “Coastal cities struggling to keep rising sea levels at bay, midwestern states watching “mega-rains” destroy crops and homes, and fishing communities losing catches to warming waters, are now demanding the oil conglomerates pay damages and take urgent action to reduce further harm from burning fossil fuels”, just when you think that Americans can no longer become any more stupid, we get the next iteration of ‘stupid is as stupid does’. Statista shows us that in 1975 the US requires 1.747 BILLION kilowatt hours a year, this went up again and again until that number was well over doubled in 2005 (3.8B KwH), then it roughly stays the same. There was one spike in 2018, yet one source gives us “From 2003 to 2012, weather-related outages doubled”, I personally believe it is not all weather related. I believe that energy delivery hit a saturation point around 2005. This is why the last decade has so many of these failings and outages. Consider that it was not merely oil and gas, it was energy, the underlying need that drives this. If you doubt this you need but to read the entire ENRON scandal papers to get a clue on how it has always about greed and not about big oil and gas. When I see ‘Big Oil and gas’ I personally think it tends to be a hidden jab towards the Middle East. There have been carbon neutral solutions for almost two decades. Yes, they were expensive in the beginning, but how much effort was made to push this? It is about profit margins, it is about cheap and it is about exploitation. Oil and gas check most marks, but are they to blame? We can ignore settings like “In the early 1990s, Kenneth Lay helped to initiate the selling of electricity at market prices and, soon after, Congress approved legislation deregulating the sale of natural gas” that was almost 30 years ago, so how was electricity created? How do we get energy? And why is Congress not in the same accusation dock? Until the late 80’s the idea of Electricity at market prices was a lull and instead of protecting that part, it was left to the needy and the greedy.

So when they have another go at ‘Big Oil’ (to be honest, I have no idea what they are talking about), consider that the drive to have your own car started in the 50’s. Forbes gave us in 2020 ‘Traffic Congestion Costs U.S. Cities Billions Of Dollars Every Year’, which is fine, but that too relies on fuel, so when they gave us “New York had the highest economic losses out of any major U.S. city with congesting costing it $11 billion last year. Los Angeles lost $8.2 billion while Chicago suffered the third-worst impact at $7.6 billion.” And how much fuel is wasted in that setting? Do you want to blame ‘big oil’ for that too? This is a case that will go nowhere, the only thing it enforces is something I will touch on a little later. You see, when we saw the messages on how companies had enough of California, they vacated and left, Texas is such a much better place (it actually might be), and Forbes again gave us in February ‘Texas Energy Crisis Is An Epic Resilience And Leadership Failure’, yet how much consideration are we seeing when we get sources feeding us “There are several reasons tech companies shave been moving to Texas – lower housing costs, lower tax rates, less regulations have made it easier for companies to operate in Texas. There is already an abundance of technical talent all over Texas. Any company moving here can tap into a well-experienced talent pool. There is also a well-educated stream of new talent graduating from top schools like Texas, Rice, University of Houston, and Texas A&M.” I am not debating the act, I am fine with the action taken, but when you consider that the following companies moved to Texas, how much of a drain on energy in other places will that give you and when you see the sudden spike in some places requiring a lot more energy, all whilst the other places are not diminishing their offer, because people will always need power, how is ‘Big Oil’ to blame? So lets take a loot at that list and most names moved less then 2 year ago (or are about to move)

Guideline, Contango, Done, Carbon Neutral Energy, Tailift Material Handling, Estrada Hinojosa, GBS Enterprises, Wedgewood, Verdant Chemical, Ranchland Food, Drive Shack, Invzbl,Markaaz, XR Masters, Elevate Brands, Harmonate, Einride, Green Dot, NRG Energy, Caterpillar,Flex Logix, Leaf Telecommunications, Katapult, Wayfair, Ribbon Communications, BSU Inc, Avetta, First Foundation, 5G LLC, TaskUs, BlockCap, Element Critical, City Shoppe, CrowdStreet, Lalamove, NinjaRMM, Gilad & Gilad, MDC Vacuum, FERA Diagnostics, Roboze, Leadr, SupplyHouse.com, Eleiko, Firehawk Aerospace, International Trademark Association, ZP Better Together, Precision Global Consulting, Loop Insurance, QSAM Biosciences, AHV, Dominion Aesthetics, Sage Integration, Quali, Samsung, Truelytics, Alpha Paw, Sentry Kiosk, ProtectAll, Optimal Elite Management, Ametrine, Digital Realty, Amazing Magnets, Lion Real Estate Group, NeuraLink, Maddox Defense, DZS Inc, The Boring Company, Oracle, Hewlett Packard Enterprise,Tesla, Optym, Longevity Partners, Iron Ox, Palantir, 8VC, Bonchon, Titans of CNC, Saleen Performance Parts, CBRE, Slync.io, Baronte Securities, Omnigo Software, Incora, Vio Security, JDR Cable Systems, FileTrail, Sonim Technologies, Murphy Oil Corp, Buff City Soap, Origin Clear, QuestionPro, SignEasy, Sense, Astura, Charles Schwab, Splunk, Bill.com, Chip 1 Exchange, McKesson, and Lonza. This is not a complete list and I am not considering (at present) which ones are doing it for all kinds of tax hypes. Now consider how many people will move as well. I get it, California is expensive, but how will this change that represents the population of more than one large city impact the power needs in Texas that is already has it fair share of brownouts, and that is just for starters, how many gas and oil energy producing plants will Texas get? Is ‘Big oil’ to blame, or do they merely offer a commodity that EVERYONE needs? Consider that a powerful computer required a 200 Watt power unit in 1997, today it is 600Watt or even higher. There were roughly 51 million units sold last year alone. I cannot state how the division on laptop and desktop is, but the need for energy is unrelentingly large, how large? Consider all the staff moving to Texas and consider how many more energy issues Texas has in the next two years, that is your marker and ‘Big Oil’ had nothing to do with this.

So when we reconsider “wave of lawsuits, filed by cities and states across the US”, how many of these claimants voted against wind farms, against solar power and against nuclear power? They did it for all kinds of reasons and we get it, some are expensive and you do not want your children to go to school glowing in the dark (yet in winter that is a case for less accidents), but in all this blaming ‘Big Oil’ is just too ludicrous to mention. So as for a promise earlier in this article. When the US goes on with silly and stupid court cases, how long until the owners of IP and Patents will consider the US to be too dangerous to remain in? Consider that the US has an IP value of $21,000,000,000,000 (trillion), it represents almost 90% of the S&P 500 value, so what do you think happens when a massive slice of that moves to Asia or the Middle East, optionally to Europe? I reckon that over 70% of Wall Street executives are on a floor above the 30th and there is every chance that well over 40% of them will do a (at https://www.youtube.com/watch?v=cEpKcBkkVMY); now consider the stage of blaming the wrong party. I am not stating that any of the energy delivering components are innocent, yet we are all guilty, in almost every nation. We remained silent when energy prices remained the same (somehow), we have known about alternatives and most people never pushed their politicians, we have known about the dangers of erosion for decades and we see pollution report after report, yet nothing is done. We are all to blame and putting ‘Big Oil and Gas’ in the dock will never ever go anywhere, I reckon that Kenneth Lay set the charter for that. When we realise that we allowed a utility to become profit driven which we clearly get from ‘the selling of electricity at market prices’, we changed a whole range of processes and now that we see the impact we should not cry, we should look into the mirror for blame.