That what we think we know is a dangerous setting. We can know things on presumption and that is fine. How will anyone react tends to be also in the cards. But to sell the pelt of any animal before you make good on the kill is very dangerous. The idea that allies are bound into a sense of understanding is one thing. But tell me this, how is this set into reality?

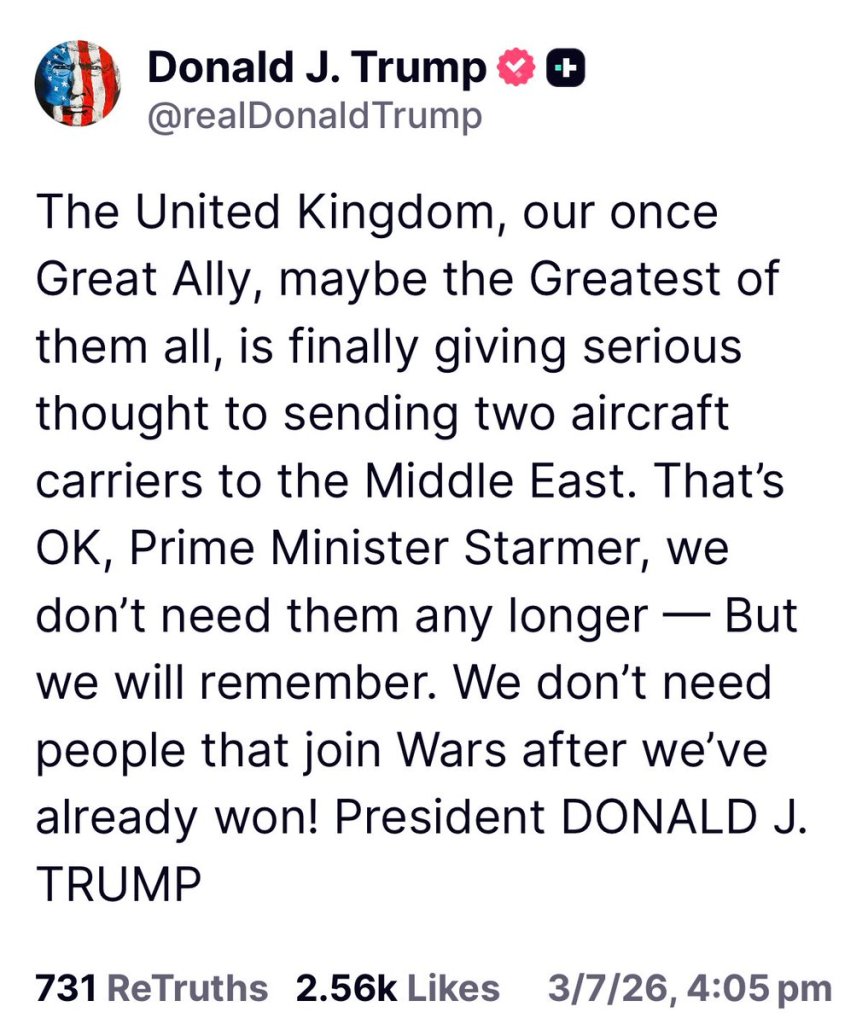

So how is “We don’t need people that join Wars after we’ve already won! President DONALD J. TRUMP” realistic? Is there a win? Was there a war? You see the United States of America never declared war on anyone and that will haunt President Trump long after he is taken out of office. You see, America is now playing a very dangerous game. Not only is his economy (basically) tanking, but at present he has no allies left. Then ABC gives us “As of March 2026, Saudi Arabia, along with other Gulf states, is reportedly reviewing its international financial commitments, including potential reductions in U.S. investments. Driven by budget pressures, lower energy revenues, and regional tensions, this shift is considered a precautionary strategy rather than an immediate, full withdrawal.” Some make claim that this is around 5 trillion dollars (aka $5,000,000,000,000) and in light of the debt they already have (As of March 5, 2026, the total U.S. national debt is approximately $38,870,000,000,000 trillion) so the United States of America is in a bundle and I reckon that they want to reduce Iran into a cinder so that they can claim the oil, they won’t make that claim, they merely buy all the oil at a speculative $0.50 per barrel). But that is merely my speculative view. The AFR, or Australian Financial Review (at https://www.afr.com/world/middle-east/trump-s-war-on-iran-is-a-long-way-from-won-20260304-p5o7hu) gives us ‘Trump’s war on Iran is a long way from won’ where we see “As the second week of “Operation Epic Fury” rumbles on, the duration of the widening conflict across the Middle East and its impact on the global economy and Australia remain uncertain. US-Israeli air strikes have succeeded in decapitating Iran’s high command and degrading its military and naval capacity. Yet, like the hydra regenerating after the head is cut off, there is no certainty the regime has been defeated after the son of the assassinated supreme leader Ali Khamenei was appointed his successor.” (The rest is behind a paywall). But I had my own version of systems and I have gifted all my military IP to both the UAE and Saudi Arabia. Iran needs to be defeated as it attacked the gulf states. And as my IP destroys their harbors and railway lines. Iran will have serious problems with their infrastructure soon enough. I wrote about this in the last few days.

I think that if they are willing to attack civilian targets, then I can send my IP to them to aid them in their fight against Iran and the setting that Saudi Arabia has been under attack by Iran in proxy warfare makes the decision easier. I might not make any money, but at least it will serve a greater purpose and that is fine with me.

And now as Mojtaba Khamenei is selected as the new supreme leader there is every chance that both Israel and the United States of America will face more weeks of warfare. Is there a chance it will be over soon? It is not impossible but only if Tehran, Mashhad, Isfahan, Karaj and Tabriz are totally reduced to rubble and in the meantime the press (always eager to make digital dollars) are watching every bomb that falls. Only in the first week were we given ‘US investigators believe strike on Iranian girls’ school probably carried out by US forces’ (at https://www.theguardian.com/world/2026/mar/06/us-investigators-believe-strike-on-iranian-girls-school-likely-carried-out-by-us-forces) and now we hear rumors (unconfirmed facts) that the schools was accidentally targeted twice. So they screwed up twice and now they need to make a victory, but what will it take? More important, does the United States of America have the cash to set this war into reality? And there are several other facts that are in doubt. I reckon that if the gulf states remove their 5 trillion, life in the United States will become really hard soon enough, and the setting to piss of Sir Keir Rodney Starmer and the British people is about to have a considerable price tag. Didn’t anyone tell this president the story that you cannot sell the hide of an animal before you kill it? It is a simple question really.

So have a great day and enjoy the sunshine (if there is any).