Yes, it is the old axiom again and for a long time there was an expression it was “Crime does not pay”, we saw the old remedy in this and we saw it repeated in movies, in TV. The simple given truth that crime does not pay.

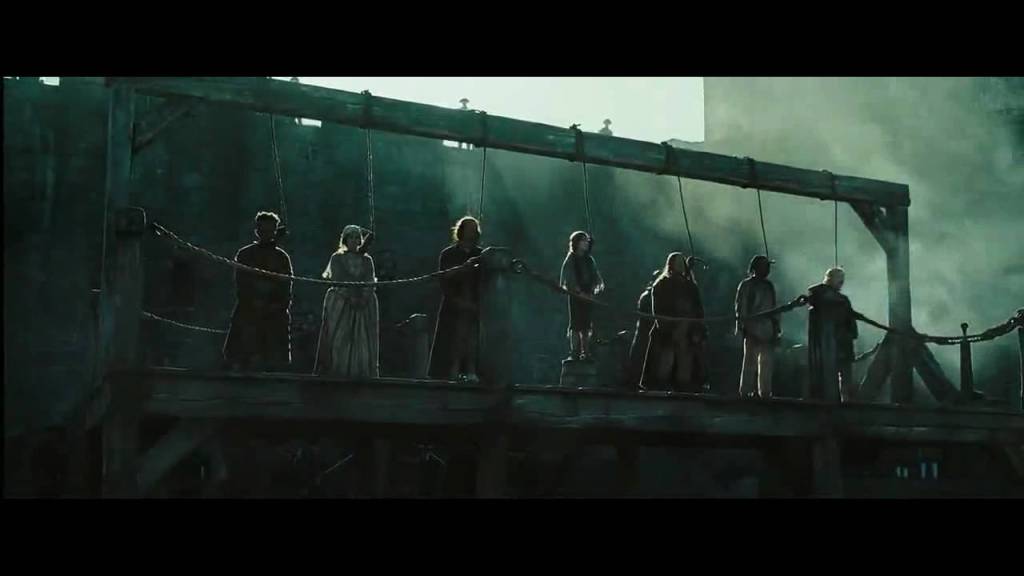

But the world evolved, capital crime left us, judges (or as some call them lobotomised lawyers) became pussies all whilst police and politicians became even less useful. So in the last 2 decades crime became massively rewarding. Not small crimes though, the bigger the crime the larger the chance of running away and for the few that did get caught places like Netflix offer large sums of money for the movie rights. You think I am kidding? Consider the BBC giving us (at https://www.bbc.com/news/technology-61966824) ‘Missing crypto queen: Is Dr Ruja Ignatova the biggest Bitcoin holder?’ There we see “The scammer disappeared in 2017 as her cryptocurrency OneCoin was at its height – attracting billions from investors. Fraud and money-laundering charges in the US have led to her becoming one of the FBI’s 10 most wanted fugitives. The Oxford-educated entrepreneur told investors she had created the “Bitcoin killer”, but the files suggest she secretly amassed billions in her rival currency before she disappeared.” With the added “Details first surfaced in 2021 in leaked documents from Dubai’s courts, posted online by a lawyer who crowned Dr Ruja – as she’s known – the “most successful criminal in history”” so what gives rise to this article? Well that is the nice part. I first crossed virtual paths with her in ‘The citizen model’ (at https://lawlordtobe.com/2021/11/03/the-citizen-model/) it was November 2021. And there I wrote “apart from the stage of Fraud and scamming, she broke no laws, she was extremely careful not to break any. Then on 25 October that year she boarded a Ryanair flight from Sofia to Athens, and vanished off the face of the Earth.” We got to the fact that a lease was signed in 2016 and we were in addition given “the lease was signed in August 2016, financial regulators in at least one European country had already issued a warning about OneCoin. A few months earlier, Dr Ruja had pleaded guilty to fraud and other charges in a German court, after bankrupting a metal factory she’d bought and leaving 150 people jobless in 2011” as such there were issues going back to 2011. And in 2022 (7 hours ago) we see she is now FBI’s top 10 people. The law required 6 years, 6 years where she lived as the queen she was labeled to be. Optionally having a high-rise floor in Dubai with views like this

As her ‘personal’ retirement place. Reading books, watching movies, drinking and having whatever she needs delivered to her floor, or the office of her personal assistant. 6 years and optionally 6 more years, or perhaps even 16 more years. Now you might want to go that way and try to become the next whatever it is you think you’ll be. Yet like quarterbacks, Nobel winners and Stanley cup holders, very few get there and those who do not will be made an example of, that is the only direction the law can go now. They need to rectify 6 years of blunders on one case alone. The UK (London) will have to adjust their secrecy policy on housing and there is a lot more that needs to happen. In the end there is no way telling where this goes, but the one criminal who got away with well over 5 billion might be the last one in generations to do so.

The simple truth is now becoming that either they make sure that the story of ‘Crime does not pay’ becomes a reality or chaos will be the next hurdle they face and as far as I can tell, there is no western government that can properly deal with any kind of chaos. They fear it more than crime. It is one of the hard lessons the UK learned last year, and a few other governments learned this lesson the hard way too. The pandemic made that crystal clear. And in a world where some freedom of movement remains, these criminals will be hard pushed to get to any place where they are not wanted, where they can hide in luxury like hermits, their houses beyond large, beyond well equipped and beyond reproach and that is where they will spend the next two decades as the world goes under through war, poverty and lack of resources. They got out in time and Dr Ruja Ignatova might be the last one to do so. In the mean time the FBI is looking for her in places where they have no jurisdiction, where they get no cooperation and they can look and state “She is not in the US”, which might have been the one mistake Ghislaine Maxwell had made. For some people crime paid better and it is still the foundation of their lavish lifestyle until 2050. After that people like Dr Ruja Ignatova will offer their life story for immunity and money to Netflix and some will treasure that approach because in a world of revenue cash is king, and most likely always will be.