That was the first thought I had when I saw the article ‘Academics attack George Osborne budget surplus proposal‘ (at http://www.theguardian.com/business/2015/jun/12/academics-attack-george-osborne-budget-surplus-proposal) and the title reflects on them as well as on me. You see, as stated more than once before, I have no economics degree, but I have insight in data, I am not a bookkeeper, but I know how to keep my own register (I’ll let you boil down that conundrum by yourself).

So as I have a go at 77 of the best known academic economists, I present the first quote, which is: “George Osborne’s plan to enshrine permanent budget surpluses in law is a political gimmick that ignores “basic economics”, a group of academic economists has warned“, here we see the first failing of these economists. You see, the first rule of a basic economy is plain and simple:

Do not spend more than you earn!

That has been a massive need for over 20 years! Some ‘academics’ convincing that the budget could be X (whatever the amount is, now they tell us that X = Y (part of our costs) + Z (the interest and minimal payback on a massive loan that allows us to do more). At some point, one politician was stupid enough (or forced) to do this, but then the next one did it too and so on. Now we have a game, because of a group of flagellationists, we are all whipped into a place we never wanted to be, which is deep in debt!

Were those economists wrong?

They were not IF (a very loud if) the politicians would have diminished the debt, which is now 1.5 trillion pounds. You remember the first formula (X=Y+Z), now let’s take a look. You see, the numbers have been shifted again and again. Some now state that the interest is £42.9 billion per annum (2013 numbers), So now we get X = Y + (42.9 + 30), which is the annual interest and the paying down the debt at 2%, let’s not forget that at this pace it will still take 50 years, that is, if we get a budget that is actually set!

There are other complications that will make ‘Z’ higher, or ‘X’ a lot lower, when we consider maturing bonds and all other methods of ‘borrowing’ funds. You will see that the only winner is the bank. Whomever gets paid 42.9 billion is getting that as a guarantee without ever working for it. You the readers in the UK are doing all the work for that bank. The economists are not trying to tell you that. They come with ‘it is a very complex situation’ or my favourite ‘it would take too long to explain it all’. Yet, in their own words, ‘basic economics’ is actually really simple.

Do not spend money you do not have!

Now we get the quote “the chancellor was turning a blind eye to the complexities of a 21st-century economy that demanded governments remain flexible and responsive to changing global events“, which I see as a half-truth! You see, economics are quite complex, but they are only complex because economists and their friends in the financial sector MADE it complex! They get all this money for free from governments all over the world. They do not want to change that ever!

For the sake of the United Kingdom, the Commonwealth and our sanity, George Osborne is making that change. If previous Labour (especially Gordon Brown MP) had not spend the massive amounts they had, the UK would be in a much better position, but that is not the case. The economic view of ‘flexible and responsive’ is a valid point, but previous events turned ‘flexible and responsive’ into non-accountable overspending of funds that were not available. It will take a generation to clean up. The issues in Greece got so hairy that the President of the United States put his foot down, 2 days later the IMF walks away. An economy so deep in debt, an economy only representing 2% of the economy of the EEC could be able to topple it all. That is what many do not want to address!

This gets us to a linked quote in the article ‘Greece running out of time to avoid default, leaders concede‘ (at http://www.theguardian.com/business/2015/jun/12/greece-running-out-of-time-to-avoid-default-leaders-concede), where we see: “Greece has less than a week to strike a deal with its Eurozone creditors to avoid defaulting on its massive debts and perhaps being kicked out of the single currency area, with German leaders and top European Union officials now conceding that default is the likeliest outcome“, so as you might recall that Greece claimed that a solution was ‘almost’ there, I will show you the ‘flexible and responsive’ side to the word ‘almost’.

You see, “I have had sex with Laura Vandervoort almost every night!” Monday almost, Tuesday almost, Wednesday almost. You get the idea, ‘almost’ here is like ‘as soon as possible’, at times it means ‘Never!’ (it would be so much fun to get a mail from Laura stating that she will be here ‘as soon as possible’, I am not beyond irony and it will make me chuckle for weeks!

Why this example? Well, I have been telling the readers for months that Greece has been screwing us around, you see how the words just fall into place? The economy does not! This is the clear evidence that the law must change. While all the players getting nice incomes were saying ‘tomorrow’ ad infinitum, George Osborne is saying ‘Now!’

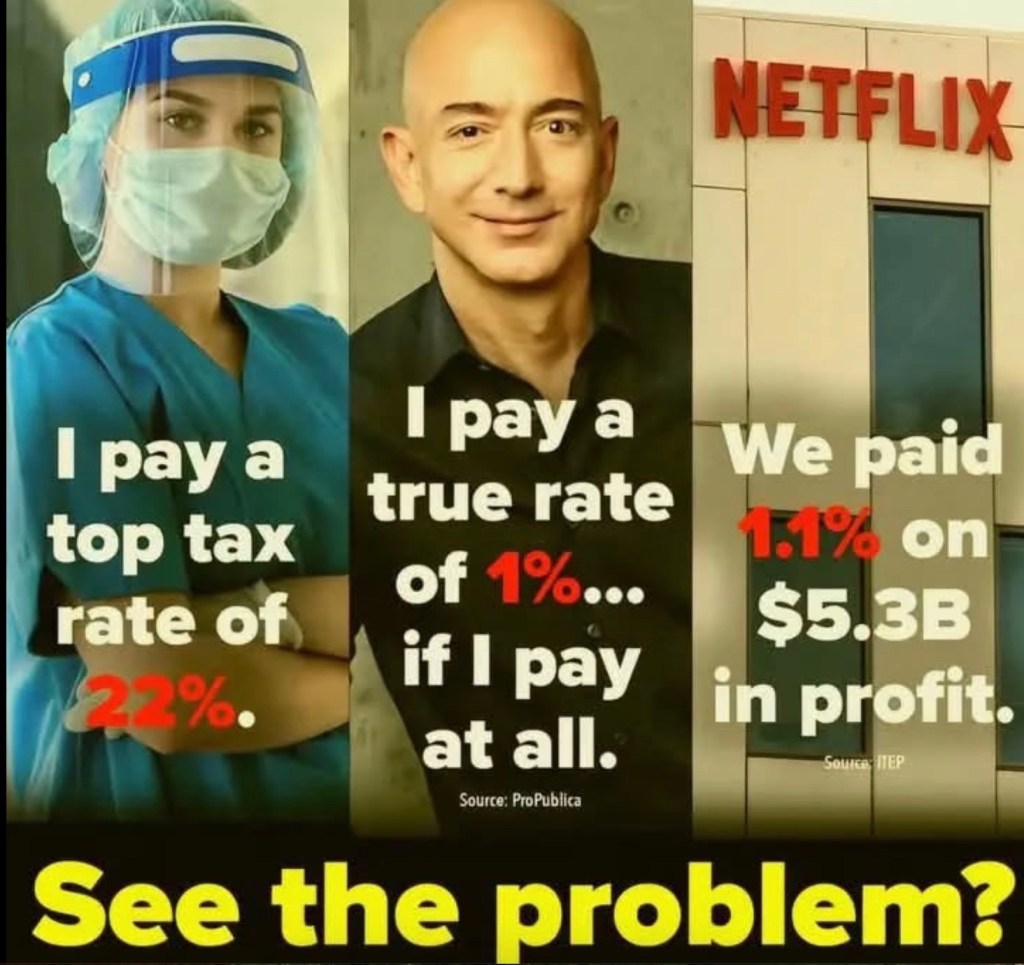

The fact that this is essential is also seen through the acts of President Obama. Tax evasion was high on the G-meetings (G-7, G-20, take your pick), yet, when Australia introduced the Google Tax, we see the us Treasury making waves to stop it ‘US Treasury pressures Tony Abbott to drop ‘Google tax’ ‘ (at http://www.afr.com/news/policy/tax/us-treasury-pressures-tony-abbott-to-drop-google-tax-20150428-1mu2sg). They stated it as: “Mr Stack said it was critical that Group of 20 countries like Australia that were participating in global tax negotiations did not pass laws on their own that would contradict international agreements“. In my words, my response would be: “Mr Stack, you and your administration are a joke! You have not acted for over three administrations in reigning in corporate greed, your American corporations were cause of a financial meltdown 11 years ago, a meltdown we are all still feeling. In addition, you have not set ANY solid ground in countering tax evasion, other than the windy speeches we have expected to see, all speech, no action! It is time for the American administration to put their actions where their mouths have been for too long!” Not too diplomatic, but the message is coming across I reckon. The commonwealth can no longer adhere to the irresponsible acts of a nation that is 18 trillion in debt!

So as I see it the quote “they argued Osborne was guilty of adopting a gimmick designed to outmanoeuvre his opponents“. You see, this is not a gimmick, this is a direct need where the banks are no longer in control, the Commonwealth is a monarchy, that is there to give a future to the people and to keep them in a place where they have a future. For now Greece basically no longer has a future. It has spent it all, unless the US treasury comes up with 50 billion (quoting Jean-Claude Juncker), it only has time to find a solution that will not end the existence of Greece.

This is the massive difference that the people keep on forgetting. The UK is a monarchy, with a sovereign ruler who has accepted (or: was given) the responsibility to keep the nation thriving and its people moving towards a happy place that has a future, America is a republic, where the elected official is depending on large contributions, especially from the wealthy. It has given in to big business again and again for the last 20 years. As we see the USA, a nation more and more drowning in civil unrest, we should consider how they got there. The got there by lacking in laws that held big business and government to account of spending. Here we now see “George Osborne’s plan to enshrine permanent budget surpluses in law“, this is an essential first step to get us all back on a decent track where we are not in debt!

Getting back to the formula. The last step we were at was: X = Y + (42.9 + 30), you see, the people all over the place have been ‘deceived’ to some extent. Deceived is hard to use, because the word ‘misrepresented’ is a much better word. X is what the UK receives. With large corporations ducking their fiscal responsibility, the value of X goes down, with unemployment issues and zero hour issues, the people get less money and as such they pay less taxation, so X goes down even further. Now we get the set costs. (Y), more and more elderly, means more costs and they do not pay taxation. So the elderly drive down X a small bit and drive up Y a large portion. I do not hold that against them! They worked, they made Britain (and Australia) great! They did their share, so they get to sit down to enjoy the tea and biscuits (an additional fine venison steak would be good too). These are all elements that the economy is confronted with and as these economists have been to enabling to big business, we see that we must put a stop to what is happening. We have no other choice, or better stated we have less and less options. These economists are all polarised into one direction, one direction that has not worked for over a decade. We get misrepresented by ‘managed bad news’ and other forms of information we can no longer rely on.

Consider that I have been on top of the Greek case for some time now, so when we see (at http://ec.europa.eu/economy_finance/eu/countries/greece_en.htm) the fact that the forecast of Greece is 0.5% in 2015 and 2.9% in 2016, I wonder how they got to it all and if such misrepresentation should not be a cause for liability? Is it based upon raw data that we can trust? You see as these economists all rely on the ‘formula’ and all concede that it is a good model and a real predictor, my gut has been a lot more accurate and these economists had to adjust their numbers downwards time and time again. The last part for Greece is seen in the Financial Times, it reflects on what I stated earlier (at http://www.ft.com/fastft/343532/eurozone-financial-fragmentation-hits-5-year-low)!

“Initiatives such as the European Stability Mechanism, a permanent rescue fund designed to limit financial chaos that might arise from an event such as a Grexit, as well as the €1.1tn quantitative easing programme, have helped insulate the rest of the Eurozone from Greece“, to ‘limit financial chaos’, is that not weird? Many players downplayed the impact of Grexit (especially France). So this ‘rescue fund’, how much is in it? You see, that will become a debt too and where does it go? France, Italy? They are in deep financial waters. So how much more will be needed to stop France and Italy to go over the edge?

Simple economics is to lower debt, now to throw money from other sources at the interest of debt, which solves nothing! George Osborne was right before, he is right now. The fact that the Economy players, the IMF and America do not like it when others are out of debt, that does not mean that we should adhere. I showed how USA adheres to big business (including banks), it is time to be self-reliant! So as rating agencies set the outlook bar to negative, we should start to wonder, who do they serve? You see, if the ratings are about the ‘now’, so the outlook is moved from Negative from Stable for an event that is not happening until 2017. Guess what, the UK was always stable, and when these ratings are shown to be ‘flawed’, then what?

To be honest, S&P has an interesting paper on this (at http://www.standardandpoors.com/aboutcreditratings/RatingsManual_PrintGuide.html). Here we see the quote “Credit ratings are opinions about credit risk published by a rating agency” and “Standard & Poor’s ratings opinions are based on analysis by experienced professionals who evaluate and interpret information received from issuers and other available sources“. Now we get the final part. The first quote is clear. It makes it known that this is a matter of opinion. The second quote is how they get it. Now tell me, how many of these ‘77 economists’, who were thumping George Osborne on all this, are involved in setting economic predictions? Are they linked to people who do set the ratings? I am not certain of the first premise, but I am decently certain of the second premise!

So are these economists, who claim that it is about ‘governments remain flexible and responsive’, is that it, or is the game getting rigged because the few are willing to sell the larger proportion of a population down the drain for the interest of self?

Consider the information given and work for a place of common sense. You will soon realise that the path of George Osborne is the right one, moreover, when in your life, has debt ever been a good thing and how is the debt working for Greece?