The Guardian is waking us up. I was already awake as I have mentioned this danger close to two years ago; actually I gave rise to the risk even before anyone had heard of Cambridge Analytica. As we see the quote: “The government is launching an inquiry into the use of personal data to set individual prices for holidays, cars and household goods, amid rising fears of a consumer rip-off” from the article (at https://www.theguardian.com/money/2018/nov/04/inquiry-personal-data-dynamic-pricing-consumer-fairness). You see, the issue is a lot larger and people are just not waking up to this danger. They all think that it isn’t really an issue, or that it will not hit them. Well, think again, it is already hitting you and the field of impact is growing on a nearly daily basis.

Setting the stage

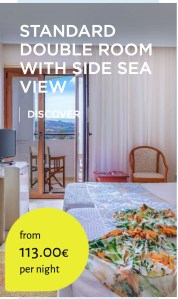

The quote goes way beyond “Philip Hammond, has asked a panel of experts led by Jason Furman, a former adviser to Barack Obama, to examine competition in the digital economy, including how machine learning and algorithms are used to set prices and whether firms could gang up to disadvantage consumers“. You see, the large issues are actually the ones that are known in advance. World Business Forum, Forbes Women’s Summit, B2B Marketing Forum, E3, ComiCon, Call Center Week and so on. Some of these places are not merely known in advance, some will go to known places like Viva Las Vegas, so the impact is not as large as one would think, although an additional 2500 hotel rooms is still an impact. No, it is the other stuff, the IP World Summit – Amsterdam, the London Law Expo 2018. Niche markets where we think that it is merely a business venture and the expenses will not be noticed, that is where the coin is found and the impact and influence is felt over a larger group.

Even as it is currently states as ‘could’, the quote “when you think about posting to Facebook, Twitter, or Instagram, you probably don’t consider how it could affect your insurance. The truth is, social media could very well become a standard part of the insurance underwriting process in the not too distant future“, I personally believe that it is already impacting people. The example in the US Insurance agent is: ‘Taking pictures while driving and uploading them to social media could result in having your policy non-renewed based on the implication that you are a distracted driver‘, Yet in Ireland alone we see ‘14,000 drivers caught on their phones in 2017 – and some were posing for selfies‘. Now consider that you must comply with: “If you received a fixed penalty notice for a road traffic offence, you will need to disclose this to motor insurance providers for five years if you were 18 or over at the time“, at this point your premium goes up by a fair bit, it is something that can often be checked and even those not convicted can be hit with an increase, you have become a risk. In addition, tat lovely new phone you have is also the issue as ‘Why social media posts could invalidate your home insurance‘. Here it is not merely what you do, but where you were. So as we see: “Insurers are increasingly rejecting claims made by customers whose houses have been burgled while on holiday if they have shared the fact that they are away from home on Facebook, Twitter or Instagram“. Yet, this is the small stuff. Life insurances are seen harsher. Insurance companies are getting more and more savvy in analysing photos online. You see, that one cigarette, or even a cigar to celebrate a birth has impact. The policy is: ‘if you smoke at all, you are considered a smoker and your rates will be higher‘, it gets to be worse. If you claimed that you were a non-smoker and the insurance company can find two pics of you smoking, you could be regarded as fraudulent and it nullifies your life insurance, so as you get planted six foot deep at some grassy field, whomever you left behind ends up not getting a penny. Decades of premiums paid down the drain. This is the direct and clear stuff, yet in that stage, we see the impact of fees, premiums and algorithms. The story takes a deep turn for the worse there.

The real and the not so real stage

Consider that every convention is online, every events is documented. Instead of the airlines setting the stage of the need for an additional plane in advance, they do that and increase the price of the fee. We might think that it is normal when we see: “The average cost of a flight out of the UK to all destinations between the 16th and 31st of December is 12 per cent higher on the big day itself“, yet if you knew this a year in advance, the increase is a little less normal, even as we understand that the bulk wants to get there on that day, now consider that this is applied to a stage where it is not thousands, but hundreds more and the issue is not Christmas, but an event in New Jersey, or a convention in Budapest. Yet, this is still merely the top of the iceberg. What if it is not a flight, but an item you desperately need to buy online? Not some Ubermeal, but the version of ‘John Lewis to launch £10,000 ‘private shopping’ service‘, a service where you always pay premium. Now, we might not care as these people are wealthy and they will not mind paying a few extra £’s on the dollar. Yet, that model will also impact the general population, it’s merely the stage as something becomes a ‘phase’ we all want it, most people tend to be sheep, and there is a loaded part here. Is it wrong for a place like John Lewis to maximise on their stock? It is merely ‘whether firms could gang up to disadvantage consumers‘, is that still the case? The point is that this is becoming a grey area. Even as we see the customer care part of: ‘another new service is called the Shopping List, under which a member of John Lewis’s team can be booked free of charge to gather either a specific basket of items or to help pick out gifts for specific people‘. The data behind it can become much more lucrative. Even as we see the battering that many of these stores have taken, and we are notified (again) of ‘It has also spent millions of pounds on improving its home delivery infrastructure and IT systems to cater to demand for online shopping‘. That data can prove to be invaluable setting the next stage in all this and the question is not merely what the watchdog is saying it is, but the underlying part becomes, if this is about staying afloat, about maximising the revenue, is there a case of ‘disadvantage consumers‘, or are we seeing the data impact of optional fraudulent claims of healthcare benefits whilst the subscriber was not completely honest on the application form. Even as I agree that the people need to wake up, even as I have stated that the people are in a vice, part of it is done to themselves. Now, I am less inclined to stand on the side of the insurance on the burgled house whilst doing the dance party 24:7 on Ibiza. It was not the person; it was the burglar in all this that is at fault. Yet the opposite that ‘telling’ a person that a house is safe and unguarded is still a dangerous step and even as we are so shareable in some ways, we need to see that this data is now a hazard to the quality of our lives. The question is more ‘what should you never do‘ and not ‘did you set yourself up to be the disadvantaged consumer?‘ We all know that Christmas presents are the best bought two days after Christmas, so even as we know that the price is higher on December 24th; can we blame the seller for charging 110% 21-24 December, knowing he will try to sell it as 65% on December 27-30? We forget on the stage that we set ourselves. On a rainy day an umbrella might optionally be £1 more expensive, yet is this data we are looking at, or can we claim that we know that we are knowingly selling to aquaphobes that day? The second is a clear stage of ‘disadvantage consumers‘. This stage is moving as dashboards can be changed in every way. You see if the answer does not match, you merely change the question which is politics 101. Data is actually almost the same, it is not on the results; it is now the population that makes the result. It is the grasp of an Old Dutch joke: “We see the impact where mothers are no longer working in families with 2.4 children“, so basically a pregnant woman with 2 children is unlikely seek employment, or to be employed; it is the same yet presented completely different. And when you consider the stage (the 70’s) is behind that, we see that this stage has merely matured in both the application of the spoken word, as well as the stage of presented facts. If we see that a number is, or that a factor applies, we automatically assume certain stages. As it is about a gender, or a location, yet it is still a weighted part, a presented population (the people that were part of the equation) and this field is growing exponentially. Consider that Google is adding close to a million facts every hour (highly speculative), this ensures not merely what is known about a person; it also makes its advertisement drive more efficient. Google’s non advertisement share grew by 14% in the last year. The other side, its advertising accounted for a total of 111 billion U.S. dollars. To make this grow, data granularity becomes increasingly important and even as Google does not allow individual access to data, the fact that some facts can be found, means that more and more will be known about everyone and a lot of it through our own actions. Selfies, Geo-tagging, and other parts are making identification and classification happen in all this. Even as we push forward in one direction, we give it away in another. It does not matter whether we move in Google Ads, or push towards Amazon Ads. We give away our details and we think that what one sees, none of the others see it, it is that part that is the folly, whatever we share online is almost instantly known to everyone and machine learning is merely making the exchange (read: collecting) of our details more efficient.

How we get charged

Yes the alarm clock needs to go ding dong, preferably at 100db so that you actually wake up. Even as it was a little over 6 months ago, Miles Brignall gave us: “Next time your car insurance renewal comes through, don’t fall into the trap of describing yourself as unemployed if, for example, you are retired, a student or a housewife/house husband. If you do, you could end up paying 50% more“, a comparison where they merely changed recorded occupation, now consider how up to date your LinkedIn account is. Do you still think that it will not matter your case? When you are confronted with: “MoneySuperMarket says students and retired people who mistakenly describe themselves as “unemployed” have the most to lose – potentially up to £700 a year in the worst cases. Retirees who do the same may have to cough up an additional 37%, it found.” Now we see the danger, this is not maximised ‘retail effort’ this is clearly a stage of ‘disadvantage consumers‘ and it came from an optional direction we never considered, because if LinkedIn is the one place where we can get a new job, how dangerous should their system be regarded when our cost of living could be hit by an additional 50%? And this is not via Hacked Data, this is you the optional consumer and in need of services being as visible as possible, a part you never expected is now affecting you in other ways too.

I have always believed that LinkedIn is a massive force for good, yet others have found an alternative use of that and with hundreds of thousands facing an optional £250 a year extra; we now have merely one side that starts amounting to some serious cash. So when you tell me who ignores such serious levels of cash, I will at that point introduce you to a liar. It is that simple in this day and age, machine learning is merely changing the threshold of you paying extra. It is a great benefit, but in some hands it will be their revenue benefit, and takes your cost of living through the roof.

Yet the question for me remains that even as I believe such a watchdog to be essential, there is a question on how effective they will be at the end of the day, because when the conversation degrades to a ‘he claimed‘, whilst ‘he gave in writing‘ against ‘he posted freely online‘, to the opposition trying to make a ‘disadvantage consumers‘ case, we will end up seeing a case that is unlikely to ever be won.