That is what I saw two days ago when the BBC gave us (at https://www.bbc.com/news/articles/cq8dq47j5y8o) ‘South Africa hits back after Trump says US won’t invite it for G20 next year’ the article gives us the setting “South Africa’s President Cyril Ramaphosa has described as “regrettable” the announcement by US President Donald Trump that South Africa would not be invited to take part in next year’s G20 summit in Florida. In a social media post, Trump said South Africa had refused to hand over the G20 presidency to a US embassy representative at last week’s summit in Johannesburg.” As well as “Ramaphosa said in a statement that the US had been expected to participate in the G20 meetings, “but unfortunately, it elected not to attend the G20 Leaders Summit in Johannesburg out of its own volition”. He however noted that some US businesses and civil society entities were present. He said that since the US delegation was not there, “instruments of the G20 Presidency were duly handed over to a US Embassy official at the Headquarters of South Africa’s Department of International Relations and Cooperation”.” There is as I personally see as I see it a second reason. Is the reason perhaps that America is in such a disastrous financial situation that he felt compelled to evade the G20? He can approach the entire setting to the press with ‘Quiet piggy’ settings, but the 15 strongest economies can not be answered in that same manners. There he has to answer and his department of War and the house of missing coins can’t shield him from that. This year Canada took home the beef, the champagne and the bacon. Next year? That is something he is unwilling to face at present. He needs to be reinsured that all the trillions that are changing between hands over 7 companies will do him good and at present the setting of Stargate is currently set at a economic windfall of minus 500 billion and that was not what he advertised a year ago and it is merely one of several failures. And at present these 7 big bloated companies are at best bringing in 3% of what is required (an inaccurate presumption) but that setting is what he is looking at and at present there is no upside to the numbers of 2027 and 2028.

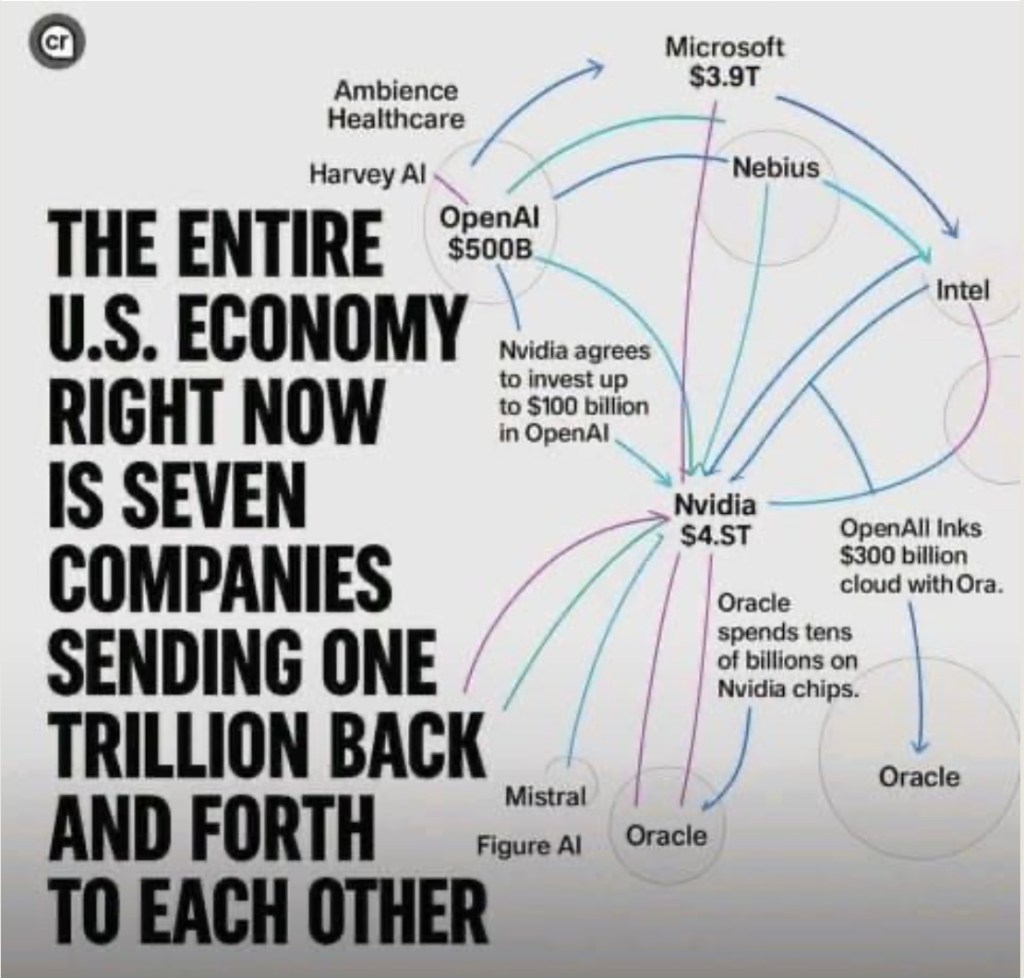

The image above was shown in LinkedIn, I never thought of it this way, where we see “The entire U.S. economy right now is seven companies sending one trillion back and forth to each other” that is how it could be seen (credit of image unknown) but is that GDP revenue? I reckon that some might validly disagree and that is before you consider what OpenAI is costing America and Microsoft (at 3% revenue it isn’t really an asset is it?)

And beyond that tourism is falling flat, and America is representing itself to be nothing more than a third world country, the president of the United States is likely to be marginally better than South Africa or Argentina, making it 17th place at best. The GDP setting in December 2024 (which was 29185) will be seen as a jolly time, by next year America is likely (a clear speculation) to be less than 13913 making it a little more fortunate than India which manages this at 5 times the population. Would you gathers in that crowd after you proclaimed year after year that America was doing so well? The defense industry is losing revenue, tourism is down massively and that Oxford Economics report stating that it is costing America $50 billion, which is 400% worse than the numbers we see thrown in the media. Then jobs are down and as I see it retail is massively down. in addition we see Aluminum smelters are down, only 4 in 24 are operating. They cannot deal with the unsustainable operating cost and that list goes on. So what happens when soda cans become an issue? American dream states are set to operate a soda can, opening it and drinking it (in the Miami sun), so I reckon that 2026 will bring its own entertainment to behold and at present , I reckon that President Trump is merely showing up to do some photo moments, so who will be ‘advocating’ how well America is doing?

I reckon it sucks to be the the man in charge at the Federal Reserve. And only 8 hours we were given “Federal Reserve has managed to push up bank reserves for 4 weeks now, but they’re running out of tools in the toolbox and will soon have to resume asset purchases, euphemistically called “QE” for quantitative easing, i.e., money printing:” (source: E.J. Antoni, Ph.D.) so as we accept that Jerome Powell is (for now) the Chair of the Federal Reserve of the United States. I cannot recall that America has given any voice to the effects (or benefits) of Quantitive Easing. So is it real? What is Jerome Powell up to? It is a fair question as President Trump doesn’t really understand economics, optionally even less than me. As I see it, he filed for bankruptcy 6 times, the last time was due to the 2008 mess, so if people argue 5 times I would accept that. As I see it, he needed to make Jerome Powell his best friend and seek his assistance in avoiding the setting America is facing these days. And my smirking sense of humor (an evil one) is wondering if America can even afford hosting the 2026 G20 summit. As I see it (and I might definitely be wrong) is that America is using South Africa to get the 2026 setting taken away from them. As I see it, Canada or the EU is a much better place in 2026. There might be a reason to hope for Canada, as he will see it as a reason to make the speculative statement that he is leaving the G20 to his 51st state (making Canadians angry to say the least).

But as I see it, I actually don’t know. And I reckon that most DML systems cannot either as this setting has never taken place before, the American economy is in an mess and not a good one.

This is what you call the perfect setting to be hosting the G20 in 2026, apparently in Miami, so order your sodas in advance.

Is there more bad news, is countered by me with ‘Does there need to be?’ A setting that is voiced by many. As I see it, the GDP in 2023 The gross domestic product (GDP) for the Los Angeles metro area was approximately $1.30 trillion in 2023, now we know that Los Angeles had dreadful fires, but the current situation isn’t helping and what will California report in revenue for 2024 and 2025? We will know some of these numbers in December, giving a lot more visibility to the hardship America is facing and there is no hiding from those numbers (playing them will be worse). America is stopping to be a great place to be and as I see it, there aren’t too many countries lining up to be their friend at present. Trump squashed that route of healing too.

Have a great day, I am almost late for breakfast.