I have wondered about that for a while and asked that very same question of that place. But some economist spoke that a nation cannot be broke (technically correct) and it reminded me of a 30 year old joke. A helicopter pilot was circling buildings in Chicago, to get his bearing, but he had no clue as the fog was too thick. So he mimed asking ‘Where am I?’ To people in a building. They wrote on a large sign ‘You are in a helicopter’ he thought for a moment, set his course and altitude and within 10 minutes he landed safely at the airport. The passengers asked how he did that and the pilot answered ‘The answer was technically correct but utterly useless, so I could only have been at the IBM Statistics building, from there on it was easy’ You think this is partially useless and you will be wrong, because we are diverting our attention to the BBC article (at https://www.bbc.com/news/articles/ckgmd132ge4o) and the losers of that comedy. The comedy starts with ‘New Trump envoy says he will serve to make Greenland part of US’ and it is almost hilarious, but the undertow of this comedy is not a farce, it is how desperate and broke America now is. So as we are given “Trump announced on Sunday that Jeff Landry, the Republican governor of Louisiana, would become the US’s special envoy to Greenland, a semi-autonomous part of the Kingdom of Denmark. Gov Landry said in a post on X it was an honour to serve in a “volunteer position to make Greenland a part of the US”.” So loser one is Jeff Landry, who served from 1987–1998 as a Sergeant, so he knows about illegal orders. So he goes to Greenland as an envoy, not with any diplomatic status, so President Trump can feign ignorance. And this might be the final straw as Greenland bounces Landry as an unwanted person the stage is decently set so that President Trump can invade Greenland to ‘avenge’ his former governor.

And the question that I am getting is not the one you would expect “How broke is America?” You see after the folly of making Canada the 51st state (something that was doomed to fail) and now he is going after the Venezuelan oil calling it stolen from America. Weird, because Venezuela was never part of the USA. And now he goes after Greenland and now he get the EU and optionally Canada against him. He is after the riches of these places, minerals and expansion and it gives a rather bitter taste of alignments. The bitterness is that America might be so broke that this is their only option before they have to cancel debts they have. They cannot play this game any longer as I see it. And the wealth hidden on Greenland is all that is left to play.

So, after he destroyed his alignments and destroying his tourism there is little left of the bankable economy of America. He stated that he didn’t need anything, but without Canadian energy settings and Canadian aluminum, America has a bitter future ahead and those enjoying this Christmas better make it count, because for Americans it is likely the last jolly Christmas they will have in close to a decade. The game is up, but there is one upside for President Trump. There is a likelihood that he drove the EU and Commonwealth straight in the arms of China

And they will reward him with the Fortnum and Mason Christmas Hamper. His final moment of eating like a King, because there will be nothing left after this mistake. His former allies see his for the enemy he has become and in a year he gave the land of the free and the home of the brave gain a reputation that is even worse than Russia has and I reckon that China owes him that hamper. America did more to advocate China’s supremacy than China could have even hoped of doing.

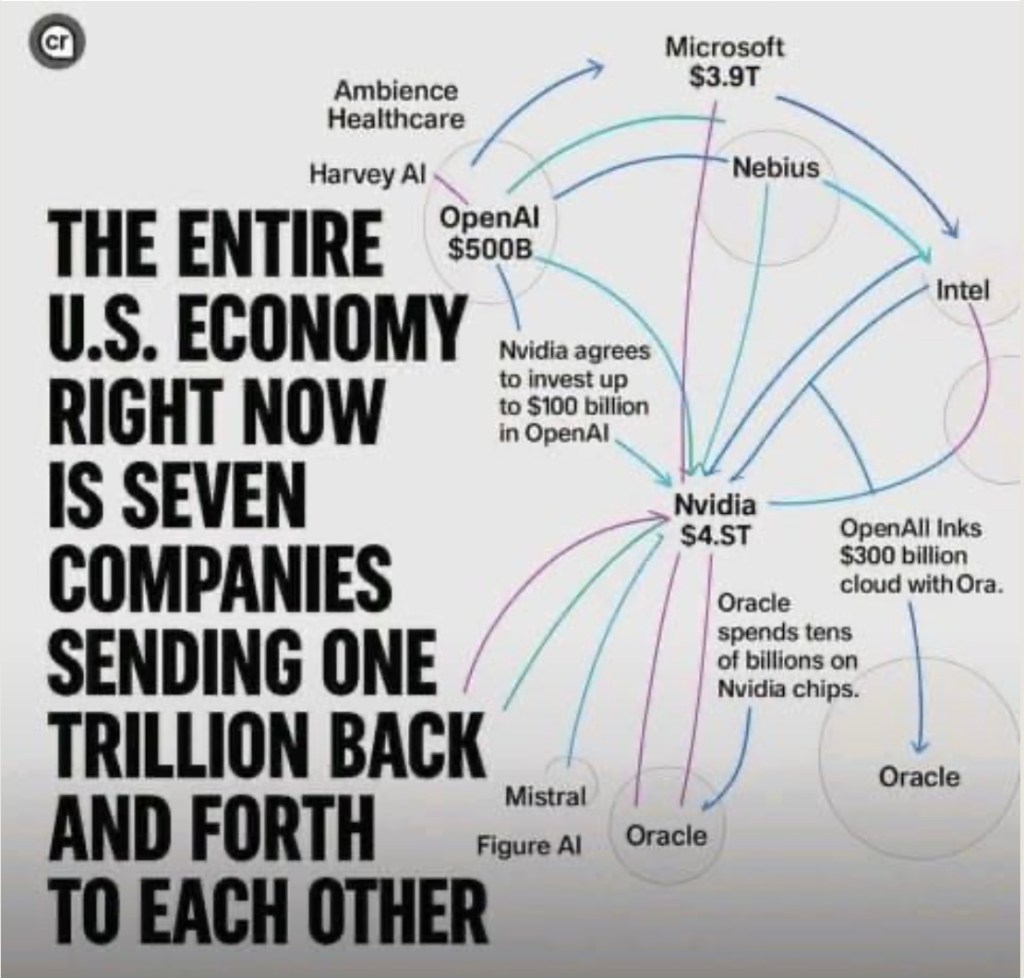

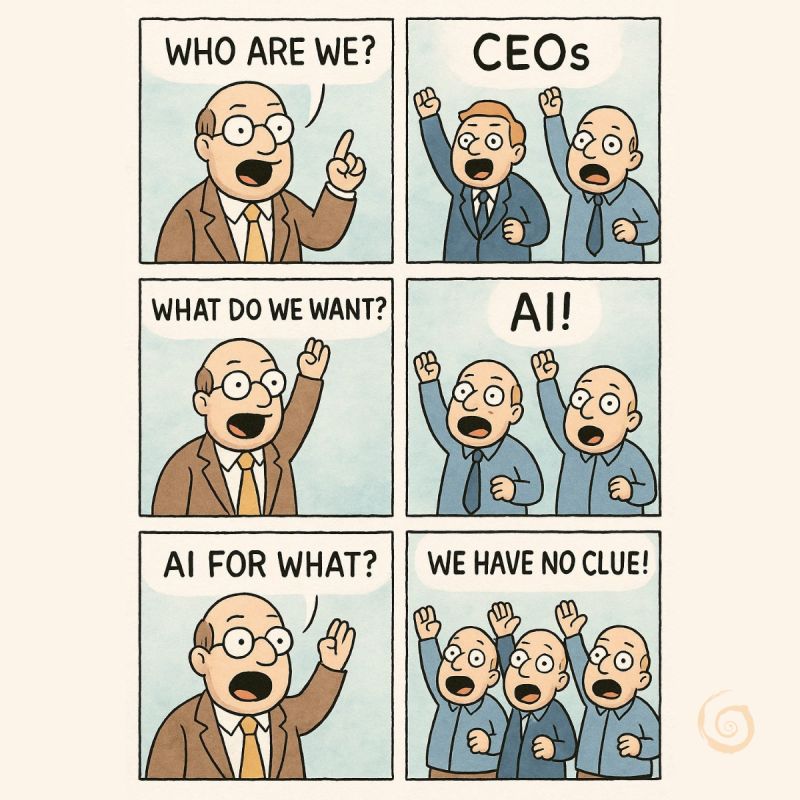

And I get that the politicians (Republicans and Democrats) know the setting they are in and they are silent, because they have nothing better to offer, even if they ‘dethrone’ president Trump today, the damage is done. Tourism will be flat for close to a decade, trade is flat because no one will do business with America. Disney and Warner Brothers are evading to the UAE and Saudi Arabia to regain some of their options over the next 5-10 years. And as we see these parks evolve, we will see the American Theme parks drop down to nothing with almost no international tourists and as the prices keep on rising in these places, even Americans will be unable to afford to go there. Then there’s production, it is down over the entire field and whilst shortages increase in America, more and more will fall flat and as such America is done and when the first debt will not be followed up on, there will be a fire sale unlike any we have ever seen and that is fun, because these AI settings all training on data it has never show such events, so they are useless as some expected them to be. So where is Stargate? Where is the AI stuff? It is somewhere out there, but as it is not making revenue until 2029, it will be too late for America, but the EU will buy it all for $0.01 of the dollar because it will be the best America is hoping to get and as such the Commonwealth will let America hang as well. So as Russian tourism evolved to the number one spot in America, the wall on the Rio Grande will get a new function, not to stop traffic from south to north, but to stop Americans going south and that might be rash and I might be correct, but as I see it the Economy in Mexico will be better than the Americans economy is and it will take less than three years to get there. So the question how broke is America is one that needs contemplation because the actions of the American administration leaves no other question out there.

And last there is the flag of Greenland, so where are the stars and stripes there? Greenland has been part of the Danish sovereignty since 1814, it is only recent that it got American interests because they need to minerals and they are seemingly willing to kill to get them and it might be the least defended one (compared to Canada and Venezuela) but Greenland is part of the EU through Denmark and those 27 states are now seeing America as the enemy it is and that might be a much tougher pill for America to swallow.

So have a great day and for the 56,836 it will be a great day, they recently learned that they have almost 500,000,000 friends who are roaring to have their backs and that is beside the allies they might get as those allies get to stick it to America.