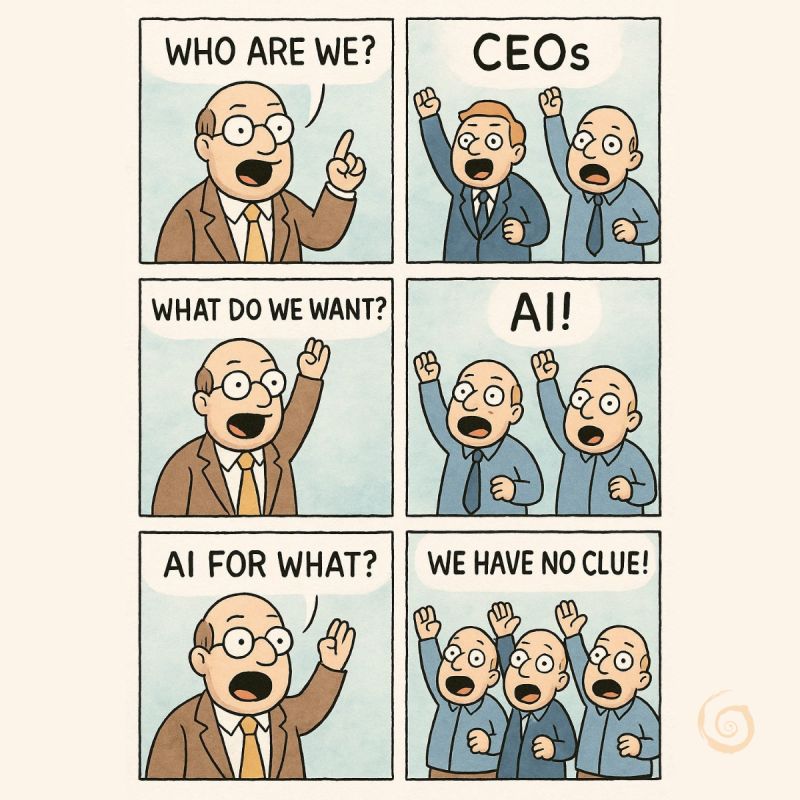

That is at times the setting we anticipate, but is that always the case? The Guardian (at https://www.theguardian.com/business/2026/jan/12/jerome-powell-investigation-explained) gives us ‘Why is Trump’s justice department investigating Fed chair Jerome Powell?’ Personally when you make blunders the way President Trump is making them, you need one man in your corner and I reckon it is supposed to be Jerome Powell, the Fed chair is supposed to be impartial, as such he would be a tremendous ally, even as the setting stands, so what gives? Well, I reckon that some see that Stage four of the American collapse has begun. I think the same thing for other reasons but their voice fills the few gaps I had, so there it is. Ad the Guardian gives us “Powell publicly denounced the inquiry as punishment for not bowing to the president’s wishes on interest rates” too, right under the headline. As such we are also given that “Trump has long wanted the Fed to lower interest rates, claiming that cutting rates would save “$1tn a year” and spur economic activity.” But at present (as It stands) we are given “Economists have also sounded the alarm, warning that Trump’s attempts to influence the Fed could risk plunging the US into a period of 1970s-style inflation, and trigger a global backlash in financial markets.” And even as they have Jerome Powell, is not alone here. We are given “Powell alone does not set interest rates. He is part of the Federal Open Market Committee (FOMC), the 12-member board that votes eight times a year on any changes to interest rates. Though Powell is just one vote out of 12, he has enormous sway as the most influential voice on the state of the US economy.” And this comes with “Fed economists often refer to the central bank’s “dual mandate”: mitigating price increases, while keeping unemployment low. Cutting rates too quickly risks higher inflation in the long term, but rates that are too high can stagnate the labor market.” To translate this, we have a house, there are three element that can be set. The house can be built Fast<>Slow, The quality of the house can be High<> Low and the Price can be High<>Low. Now the game tells us that we can set two dials, the third is forced upon us. So we can have a high quality low priced house, but the speed will then be slow. You get the idea, the third dial never ever goes your way and that is what the Federal Exchange is working with and with that setting there are problems and the interest rates are the third dial. President Trump can blow all he wants like the big bad wolf, but the Exchange rates building is build out of bricks and mortar, not straw and not wood. So whilst he wants for pressure all around him, he is now facing the ‘beginning’ of what some call ‘Hyperinflation’, I am not one of them, because I lack the economic degrees to do this comfortably. But the signs have been out there. As Saudi Arabia and Chiba are selling the US Treasury bonds, the world is watching how America is drowning its own country.

All this is happening whilst ABC gives us (at https://www.abc.net.au/news/2026-01-12/criminal-investigation-opens-into-us-federal-reserve-chair/106220038) ‘US federal prosecutors open criminal inquiry into US Federal Reserve chair’ and heart we are given “US federal prosecutors have opened a criminal inquiry into the US Federal Reserve chair, Jerome Powell, he said on Sunday, local time. Mr Powell says he was threatened with criminal charges because he had set interest rates based on economic analysis rather than politics”, as well as “The legal threat amounts to a dramatic escalation in a fight between Mr Powell and US President Donald Trump, with analysts saying it could affect longer-term Australian interest rates.” As I personally see it, President Trump better come with massively verifiable evidence. There is every chance that Jerome Powell will stat some liability case with a pay out in the billions. I reckon that this will stump the economy to a much larger degree, because whomever fills that chair (I have no idea who does) better not play the political game until this president is gone, as such President Trump for the most lost all the marbles in this game and he will not get any other marbles. As such several states will seek safety FROM President Trump instead of with President Trump and the White House. I reckon that if Texas and California seek such a solution the age of the White House getting any input will be swayed towards other settings before long,. But this last part is pure speculation. But the sentiment rings true. And whilst China is dumping whatever US Bonds they might still have, it will hit America much harder that they bargained for. So whilst the ABC gives us ““On Friday, the Department of Justice served the Federal Reserve with grand jury subpoenas, threatening a criminal indictment related to my testimony before the Senate Banking Committee last June,” Mr Powell said in a statement. The testimony concerned, in part, a multi-year project to renovate historic Federal Reserve office buildings. “But this unprecedented action should be seen in the broader context of the administration’s threats and ongoing pressure,” he said. “This new threat is not about my testimony last June or about the renovation of the Federal Reserve buildings. “I have deep respect for the rule of law and for accountability in our democracy. No-one — certainly not the chair of the Federal Reserve — is above the law.”” But that opens up another an of worms, all the evidence concerning the Tariffs are now brought into the light, as such all the claims the American Administration made on the profits ‘gained’ can now be brought into the light and it will merely take one democratic voice to add this to any testimony that is given and the game is up for this Administration. As such I reckon that this is a really silly move. And when you consider the idea that this is not how this plays. Consider that one of the questions that are entertained “Why are the interest rates increasing?” And it only requires one of the following answers in any related subpoena: “The tariffs weren’t giving us the revenue we were told”, “Tourism had much less revenue in 2025 due to connected issues shutting down” or even “Canada has been cancelling orders for many billions and we have to get the articles somewhere else and more expensive” any of these three answers are needed and all three are expected to come into that setting and they would all have raised interest rates. So how about that? President Trump seemingly shot himself in the foot yet again. A folly from start to finish.

And all this is a given, because the Guardian gives us (at the end) “A statement signed by every living former Fed chair condemned the investigation, and warned that similar political attacks on independent central banks have led to unstable economies and higher costs of living.” Because that is what people want, a more expensive cost of life. As such the entire issues is stupid, ego driven and self deflating. All that because the ego of one person seemingly goes against economic rationality. So good luck with that.

So are we watching into what some call stage 4 of the American economy? It seems to fit, but I cannot tell because I lack the economic education on this, but no one is seemingly asking the economy boffins of the media either. Have a great day today.