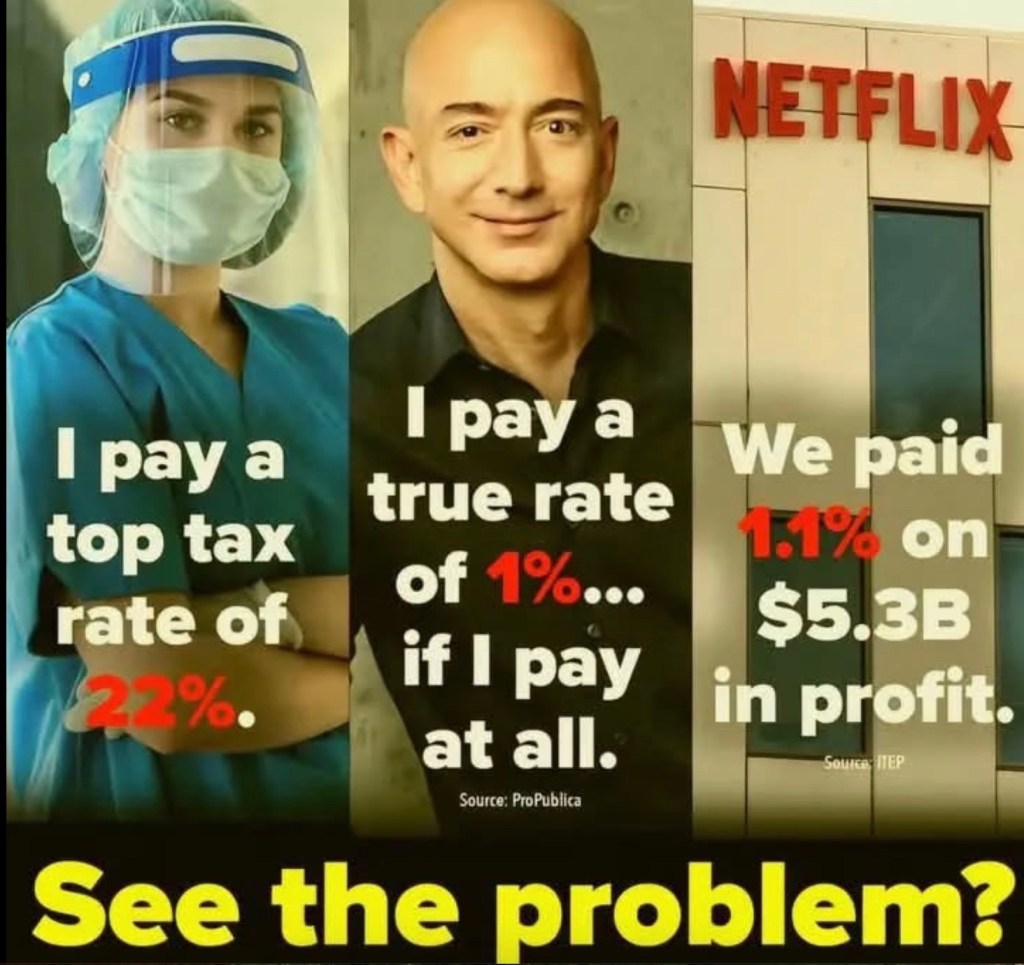

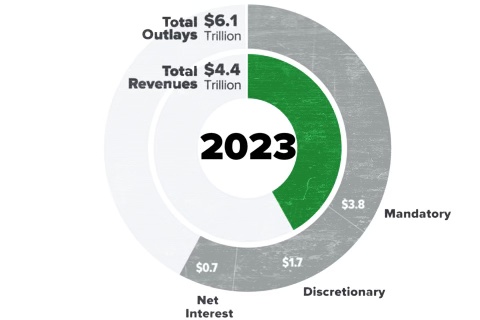

Today I got some news from initially the San Francisco Chronicle but I couldn’t get to that because of a paywall. So I found news (at https://abc7news.com/post/ca-billionaire-tax-proposal-peter-thiel-gavin-newsom-silicon-valley/18335032/) Where ABC 7 News gives us ‘Tech moguls threaten to leave CA as billionaire tax proposal gains support among unions’ and I agree as I have warned the people about this. This is not something new, it has been going on for well over a decade. I gave the setting in 2013 (at https://lawlordtobe.com/2013/02/06/it-hurts-every-time-but-we-love-it/) where I wrote ‘It hurts every time, but we love it’ then again in 2020 (at https://lawlordtobe.com/2020/05/06/new-world-order/) when I wrote ‘New World Order’ and last in 2021 when I wrote ‘Utter insanity’ (at https://lawlordtobe.com/2021/10/04/utter-insanity/) there is something wrong with political America. For over 25 years the tax laws needed to be overhauled, but they are unwilling to do that, so now they grasp at the bank settings of billionaires. Taxation is about justly taxing everyone and I agree, the Billionaires have been given a nice little ride, but overhaul of the Tax-laws is the only way it will ever work. Perhaps leaving the Apple tax rebates of the shelf. They don’t need 535 retail stores, especially when you go into a store and you have to specify on a website how you want that configuration. It gets made and after 2-3 weeks you get your new Laptop, Ive been through that setting twice in the last decade and I think that it is vulgar that they get all the tax rebates and also make it 100% tax deductible. Why does a presentation room get that (535 times). I get that it is smart, but should that be rewarded? Perhaps 50% of these stores could be made redundant, or perhaps better fully taxed. And that is merely one of dozens of cases where the American tax laws (European too) fall into a adjusted setting of ‘who cares’. So as we now see ABC 7 News, we are given “A proposal to tax billionaires in California could raise up to $100 billion to close the gap on federal health care cuts. U.S. Senator Bernie Sanders is now backing the campaign. Meanwhile, some big-name billionaires have reportedly threatened to leave the state.” And so they should. Perhaps there is something for them in Texas of Florida? And consider that these billionaires also take the bigger part of revenue out of California. So how long until that state is drying up? So whilst we get San Francisco State University Labor professor John Logan state “Most tech billionaires — who could easily afford to pay this 5-percent one-off tax– are not going to upend their lives, move to Austin, Texas, move to Florida, move to other parts of the country, given all the advantages they enjoy” is he certain that he wants to take that gamble? Texas and Florida are banking on that and when these people leave there will be a larger setting of a collapsing Californian economy. And for that mater, he might be setting the term of a ‘5-percent one-off tax’, but knowing America it is never a one off and when these people set sail to a ZERO TAX nation, the stage of fear will truly ignite, all whilst both Democrats and Republicans couldn’t be bothered with the tax overhaul, which would apply to ALL Americans. Personally I think that only former President Clinton gets a pass on this guilt trip, his books were in the green when he left. And as I see it, the ones that follow have had their hand in the debt we see now. More so as these administrations avoided dealing with a levy on roughly 9 trillion dollars (Apple, Meta, Google, Amazon, Netflix) and a few more players. All because the administrations were unable to overhaul the tax system. So there!

And better believe that I have data even preceding 2013, but that was before my blog, so that doesn’t really count, but it sets the station of avoidance to roughly a quarter of a century and that is out in the open. I don’t care what excuse they give, but at present America is broke and deliberately taxing billionaires is not the way to go. Proper taxation is and no one seems interested in doing that.

Have a great day. And enjoy the first day of the year as much as you can (nearly all timezones are on January first now).