Harsh words that are befitting a slightly harsher world than we bargained for. Yesterday I had one of those ridiculous epiphany. In my view I saw some news regarding ICE and how it is so addictive and how it is costing healthcare 500 million. There is news all over the place in both the UK and Australia regarding the abuse of both drugs and alcohol. We seem to go out of our way to reward and support stupid people. Now when it comes to simple things like consumer protection it is one thing. A person can be misinformed and a person can be misled, for this we have consumer protection to give them additional protection. I have no issue with that, when a consumer loses out on a misrepresented or misled purchase, there should be protection. For the most, many shops will exchange and usually even refund. Yet at some point in this day and age, we need to make changes, we need to adjust. It is not by choice, it is out of necessity. You see, choices were made and politicians will need to be held to account. We need to show to all around us that going soft on corporations and going too soft on the people at large can no longer be supported. You see, it is the price you pay for making a choice.

What if we change the law? As per January 1st 2017 certain medical options fall away from adults. You see, from that date, what if we stop paying for treatment of drugs and alcohol abuse. A person can only get treatment if they pay fully and pay upfront. Without that, there will be no treatment and the drugs and drunk tanks are reintroduced. You see, as stated, we no longer have an option. How can we accept that our governments push us deeper and deeper into debt, unable to keep a proper balance whilst at the same time give more and more breaks for corporations to skim from the top and become more and more non tax accountable! Until we get the law properly to properly adjust certain parts in taxation, accountability and prosecution we no longer have an option. We stop to support certain acts of stupidity. If they die? Let them!

I see images of thousands of refugees, genuinely wanting a future for them and their family, not an extremist thought in sight, just to start a life and create a future for their children. How can we stop these people and keep on supporting junkies? At 7.35 billion mankind is not going extinct any day soon, so why bother with outrageous forms of support for someone so stupid to make such mistakes again and again. In my cruel view, let them die! Let the first 100 be a clear sign to people that drugs kill, there is no next, there is no after again and again. I truly believe that it will push the use of drugs down, when more and more people are confronted that someone they directly know, who had died from drug or alcohol abuse, these elements will soon diminish to a much lower amount. It will never go away, but it will go down to such an extent that people will seriously consider not taking drugs. You see, the drugs pusher will always come with the ‘once will not hurt‘, ‘once is fine, we all do it!‘ He/she lies to you! I and many of my friends never took drugs. And let’s look at the additional benefits this solution will bring. Hospital costs go down, healthcare support goes up, less pressure on support systems and as these people relishing freedom of choice die, their places open up to you me and the refugee. All those who want a real life, a new life or a better life.

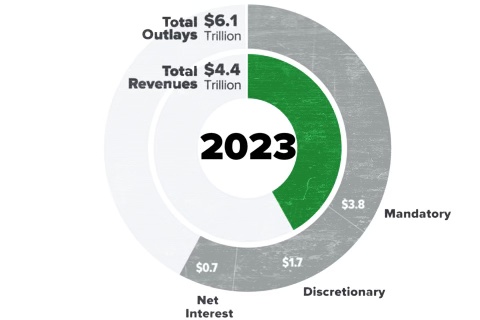

This is about more than just booze and drugs. On January 23rd 2015 I wrote ‘The danger topic‘ (at https://lawlordtobe.com/2015/01/23/the-danger-topic/), here we see the issue I raised almost a year ago. We see “At The Bruegal Institute in Brussels is not the only think-tank to believe the estimated €250bn cost of a Grexit, while covered by the bailout funds, would cripple the Eurozone and delay recovery for a decade we now see that the ECB is about to spend 1.1 trillion for bonds. When we see “The Frankfurt-based bank will use electronically created money to buy the bonds of Eurozone governments – quantitative easing – to try to boost confidence, push up inflation and drive down the value of the single currency, helping to increase exports and kick-start growth”“, yes the Italian Draghi had an idea to kick-start the economy. Now we see ‘ECB Day: markets tumble as Draghi disappoints investors‘ (at http://www.theguardian.com/business/live/2015/dec/03/ecb-stimulus-qe-negative-rates-mario-draghi-live#block-566070ebe4b073bf0735b3be). “But they may have a point. As Draghi pointed out – the Eurozone economy is growing, credit conditions are improving. QE is working, and they’ll keep doing it. Why bring out a bigger punchbowl?” and “The wave of selling rippled from Frankfurt and Paris to Madrid and Milan, as traders expressed disappointment that the ECB hadn’t expanded its QE programme, or hit the banks with tougher negative interest rates“. This is the problem for us. You see, investors expected more, they always expect more, which is why it would not work. In addition, their push could result in more spending and less and less control on that spending. I foresaw it almost a year ago, but as people ignored me and listened to these good weather forecasters on how the economy would grow, are now confronted with more and more bad news management. How the economy grew between 0.3% and 0.4%, so when we look at http://ec.europa.eu/economy_finance/eu/forecasts/2015_winter_forecast_en.htm, and we see a forecast that is written like “Growth this year is forecast to rise to 1.7% for the EU as a whole and to 1.3% for the euro area. In 2016, economic activity should grow by 2.1% and 1.9% respectively“, that 0.3% does not come close, and still these governments are living the gravy train, spending more and more and leaving the invoice for a next government who will borrow even more to deal with invoiced that cannot be dealt with. So how about taking away certain support. How about letting the people see in the street how the future is warped because the symbiotic relationship between nations and large corporations are no longer correctly honoured. Letting the system collapse is one option, letting the people die, so that those nurses can focus on nursing to true health, NHS systems on a global scale will have less and less costs and we can actually move forward.

We can no longer afford to be nice. If you doubt that, thank consider the title ‘Investors got ECB odds wrong but Draghi could pay hefty price‘ (at http://www.theguardian.com/business/nils-pratley-on-finance/2015/dec/03/investors-got-ecb-odds-wrong-but-draghi-could-pay-hefty-price), when we read “It’s hard to know who is most to blame: Mario Draghi, for leading investors up the garden path; or investors, for believing that the European Central Bank president’s talk of doing “what we must” equated to a firm promise of a bigger dose of quantitative easing“, in what way ‘bigger dose‘? We can’t even take care of the current dose and the investors want more and more and more. So, we need to think differently. When we get rid of a surplus population, more jobs, more rental places, less costs, which means lower debt options. The investors will go ‘Baahhhhh, humbug!‘, but only because greed is eternal and they require that extra cash.

When we start hitting governments a dollar for dollar (or pound for pound) option, the game will change and we will see additional false promises on how the economy will get sooo much better in 2017. I say, well, when those tax dollars come in, we can consider paying for certain treatments, only when those dollars (or pounds) are actually COLLECTED.

You know, I can already predict the answer, it will be some accounting stunt that allows for ‘spare change‘. If PriceWaterhouse Coopers comes with that option, you should ask how that worked out for Tesco, both them and the press will remains massively silent on either matter. So, we must change the game, as the players have changed the format of the game. We can’t change the players, but we can limit their actions, hence dropping services.

How inhumane is it? In equal measure I ask, how inhumane is it to leave a multi trillion debt to our children? Is Greece not a clear example, they will never escape the debt that previous governments left them, they will go through life blaming those not responsible, whilst not prosecuting those responsible, what kind of a future is that? At http://www.ibtimes.co.uk/greece-debt-crisis-athens-narrowly-passes-2016-austerity-budget-1532011 we see the title ‘Greece debt crisis: Athens narrowly passes 2016 austerity budget‘, you might think that this is good news, but so far all additional debts have been used to pay bills and pay for interest, Greece is not moving forward, which means that 5.7 billion in spending cuts is required, with one third of that as cuts towards the pensions, so the 10,000 not so poor Greeks are leaving, whilst leaving the rest to pay for an invoice no one in Greece can afford, it is not that far a thought that 2016/2017 will be the years when Greek youth, man and women will marry out of Greece so that they can have a future, reducing the future of Greece even further. Public debt will grow the coming year by another 8% towards 188% whilst unemployment will remain at 25%, so how is that any future? Statistica reported that the advantage of marrying a foreigner received 42% of the women and 33% of the men stating that ‘better education and social stability of the children‘ was received, only 2% for both gender relied on same religion, which could be a massive blow to Orthodox Greece. Whether this comes to pass is not possible to predict, but as options diminish, other solutions will be sought by those hardest hit, so is my leap of not caring for a collection of idiots that cannot accept responsibility such a massive leap? The Sydney Morning Herald reported in June (at http://www.smh.com.au/nsw/newtown-gets-busy-as-kings-cross-empties-20150619-ghseco.html): “According to NSW Bureau of Crime Statistics and Research numbers analysed by Fairfax Media, in the 10 months from April 2013 to Jan 2014 there were 86 instances of alcohol-related attacks in Newtown. From February 2014 to the end of November there were 102 attacks, an increase of 18 per cent. From January to March 2015 there were 34 assaults, compared to 27 in the same period the previous year“, so will the drunk tank be a solution? That remains to be seen, but I feel certain that the first hospital invoice to be paid upfront will definitely have an impact. As people get to pay $300 for alcohol treatment it will not go to bars, if they cannot pay, the drunk tank will be the route to take. How long until someone figures out that this lifestyle gets them killed? How about changing the lifestyle of binge drinking that has absolutely no positive impact other than a fake instilment of Ego?

We have tried all these soft labour solutions and none, I repeat none have worked. It is time that we employ different solutions.

I will be the first one to admit that it is as inhumane as it gets, but people are for the most massively stupid, especially when they are in groups, so as such less intelligent solutions must be considered. Perhaps it will work, perhaps not, but can we truly ignore the option? The cost for alcohol related abuse was $14.352b in 2010 (Australia, at http://www.aic.gov.au/publications/current%20series/tandi/441-460/tandi454.html), yet, can an alternative be found? Yes, there is one other solution, how about on June 30th all Australian residents receive an additional tax invoice of $625. If over 80% pays it, we keep to the old system, if not we will try my option, dollar for dollar. If you are unwilling to pay one way, you get to pay another way. I reckon it will not take more than 3 months until 90% plus suddenly decides to pay that additional bill.

I prefer to let the debt die, not the people, but we are running out of options and those who should truly inform us are hiding behind experts who will treat us to carefully phrased denials, how is that leading to a solution? Yes, in this blog I phrased more questions than answers. I am pretty intelligent, yet a solution cannot be given until we make massive changes to the society we currently live in so that our children and our grandchildren will have any future. When you realise that we are getting to a point that it is proven, that making the life of a person negotiable is a lot less impossible than we ever thought, that will be the point that a push for massive legislative change is more likely than not to succeed, it is the one push big business cannot counter, some things can truly push a shadow over greed, we only have to be willing to push enough people into that shadow.