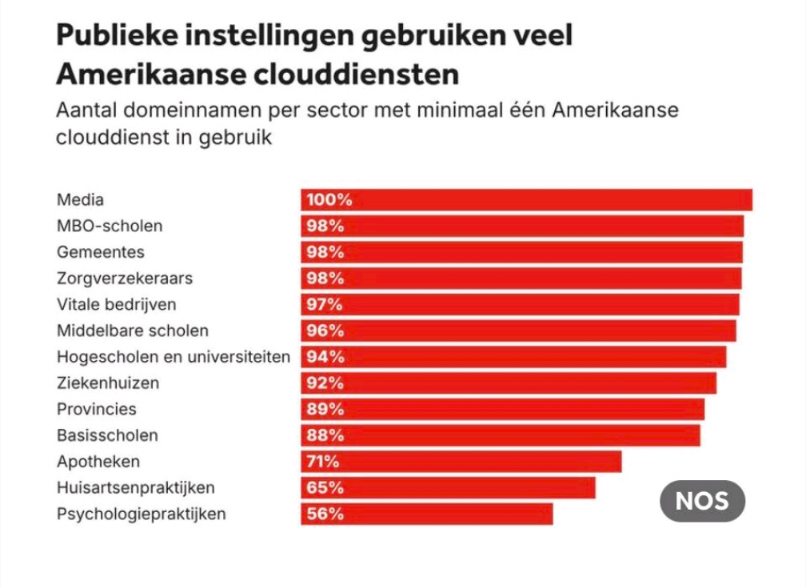

That is what I had two days ago. I didn’t act on it, because I had an IP idea and that tends to take precedence. But two days ago and for more the entire last week I have been ‘brooding’ over these grocery stores (Microsoft and Amazon) giving us that they were setting ‘localised’ protection settings and there was the rub. So here goes and I am trying to do it in certain orders (mostly chronographically). So I saw news that was a little weird, because “The U.S. CLOUD Act (passed 2018) empowers U.S. law enforcement to compel American tech companies to provide data stored on servers globally, regardless of whether the data is in the U.S. or overseas. It focuses on data control by U.S.-based entities rather than physical location. Separately, “American Cloud” refers to an independent provider offering zero egress fees, focusing on data sovereignty.” And with the intellectually challenged person they put in the white house and his ‘power hungry’ grabbing notions, the world is in clear and present danger. It was only a moment that I was confused, but this made a lot more sense than trying to grab Venezuelas oil. And I think that was what is seemingly all that need for all those data centres, the AI was merely icing on the cake, the real price is the global data that is now slowly heading to all these data centres and only localised non American set data centres are safe. As far as I know there is merely one in Sweden and that is basically it. And don’t think that you are safe, the image below shows the tainted corporations that have at least one American data centre.

The Dutch Netherlands Broadcasting Foundation (NOS) gives us that 100% of the Dutch media has American links (what a surprise) and for the rest, there is little else, only the psychiatrists have only 56% ‘tainting’ by yanks as the expression goes. As such this was brought to the surface by the Conversation who (at https://theconversation.com/microsofts-ai-deal-promises-canada-digital-sovereignty-but-is-that-a-pledge-it-can-keep-272890) gave us ‘Microsoft’s AI deal promises Canada digital sovereignty, but is that a pledge it can keep?’ Which was given to us on January 19th, as such it is BS in a jar, because as you saw, the 2018 act gives America access to it all and you have seen how boated this White House is, so as such you have no chance in hell to keep your data safe. Fortunately I had a second setting and as I ‘exploited’ a Banyan vices weakness in cloud settings, I am a little more safe than most and do you think that this is limited to global personal data? How long until you are forced to watch how American ‘corporation’ use whatever IP they can find? Some give us ‘OpenAI Plans to Take a Cut of Customers’ AI-Aided Discoveries’, so how long until the fading between that and ‘OpenAI Plans to Take a Cut of offered AI-Aided Discoveries’ that threshold is a lot smaller than you thought possible. And whilst other sources (read: NBC) give us at https://www.cnbc.com/2026/01/15/amazon-sovereign-cloud-europe-expansion.html ‘Amazon’s European sovereign cloud launch is a ‘big bet,’ AWS CEO Garman tells CNBC’ Yes and it makes no difference. Amazon and AWS are American companies as such America can grab that data. It’s like a sugar addict telling you that your jollies are safe. In this regard no follies are safe and as I see it several government should have acted in 2018, but most of these governments were possibly lulled to sleep with BS promises. As such the world has no longer any time to adjust. Personally I think that a specialized form of what was called in the 90’s as the DB virus. The virus was incredibly clever. It was a data virus unlike any other. The virus changes all your data and data went from 0 1 2 3 4 5 6 7 8 9 to 5 2 7 5 9 0 4 1 3 the problem was that until the virus was removed no one had a clue what was going on and when the virus was removed all numbers got to be hustled up, making the data useless. I reckon that a slightly more evolved setting is required here. And whomever objects can go catch an arial coitus (they are in towns with a population of 1 (you). It is all I can come up with in a few seconds but that is set into a larger setting, the viral setting is the desktop, and as it is ‘divided’ from the cloud data there is nothing America could do about it. All those Exabytes of useless data, makes my cry with laughter that is. So whilst AWS is giving us “The cloud will be “physically and logically separate” from other AWS regions, the company said.” It wouldn’t mater because AWS/Amazon is still an American company and this white house doesn’t care what you think. It is all America first, as such my option might make a little more sense. And there is still those dedicated Swedish (optionally Danish) cloud providers too who rely on Linux or at least non-American software solutions. And we all need to consider what is at stake, because this White House is a lot more desperate that we think they are. I am still sifting though data (and I have too little validation) but it seems that Goldman Sachs just offloaded $847 Billion in US Bonds (a part I cannot validate yet, but the papers are allegedly with the SEC) and if that is the case, the final pushes are now in play in America, as such they need all our data as they are getting desperate, which might take a while because the SEC has over 4400 documents involving Goldman Sachs.

But the premise of this situation is a little too dire for me to blatantly copy what other media is stating, and the media is not the trustworthy in my book. So have a great day this Sunday and as It is 14 degrees cooler than yesterday, I should be good, but with this heat I would rather be in Canada (and I reckon they prefer to be here).