Tariffs are nothing new, these things have existed for the longest time. I grew up where that was a given, so in my youth, only the rich bought a Harley, a Chrysler or a Chevy. I still remember walking to the shop in Rotterdam and look at all those awesome vehicles through the windows (I was too young to drive in those days), many grew their passion that way. It seems odd that living next to the country that made Volkswagen and Mercedes, we wanted a Blazer, a Harley or another American car. Nowadays, the petrol guzzlers they used to be wouldn’t make it today in Europe. So when we see: ‘EU tariffs force Harley-Davidson to move some production out of US‘, I merely see a stage setting to the old ways. The Guardian gives us loads of information as the market slides, as the shift of production and the changing of the US stock market. That is the direct visible impact of the Trade wars. Australia had this setting a few years earlier as the car industry packed up and left Australia for more exploitative settings in Asia. In the booming market that is stated to exist, we see ‘Harley: EU tariffs will cost $100m/year in short term‘ (source: the Guardian). this is a war the US president started and he forgot that companies, especially US ones, have one focus, short term ROI and a trade war changes the hats of many corporations overnight. This is seen to some degree as Bloomberg treated us to ‘Bigger Booby Trap for U.S. Economy‘. We get introduced to “Federal Reserve Chairman Jerome Powell said on June 20 that officials are beginning to hear that companies are postponing investment and hiring due to uncertainty about what comes next” (at https://www.bloomberg.com/news/articles/2018-06-24/trump-s-trade-war-sets-bigger-booby-trap-for-strong-u-s-economy). It is what is sometimes referred to as the corporate mindset, the consideration that tomorrow is not going to be any better for now. In all this the US hides behind “tax cuts power both consumer and company spending. That would be the strongest in almost four years and twice as fast as the first quarter’s annualized advance of 2.2 percent“, yet the US seems to forget that tax cuts also means that infrastructures are falling apart, the US has a debt it cannot seem to pay and the debt keeps on rising. This in a nation where the national debt has surpassed $21 trillion (103% of GDP), whilst in addition the statistics show that the US faces a setting where the debt per taxpayers is $175K opposing a revenue per taxpayer is merely $27K, a $148K per taxpayer shortfall, that is not the moment when tax cuts have any clear momentum, because the moment the infrastructures start failing, at that point their momentum seizes. Even as Nariman Behravesh the IHS Markit’s Macroeconomic Adviser give us “If they keep down this path, all the positive effects of the tax cut will be gone“, it is worse than that. This gives the indirect implication that unemployment rates will go up giving additional ‘attack’ against the US infrastructure. All this seems to become a direct result of the tug of war between tariffs and protectionism. The BBC gives the best light (at https://www.bbc.com/news/world-43512098), when we consider ‘Five reasons why trade wars aren’t easy to win‘. In this we see (not all five added):

- Tariffs may not actually boost steel and aluminium jobs much. The question becomes, how much of a boost would be possible, and is this proven or still merely speculation?

- Tariffs are likely to raise costs in the US, so the cost of the product will be increased as these CEO’s do not want to take it out of their margins, so it will be bookkept in another place, the consumer has to pay for all these charges in the end.

- Tariffs could hurt allies and prompt retaliation, which is already the case and when you consider that the two largest deliverers of steel are Canada and the EU, the move does not make that much sense. So we see a tariff war that will be about exemptions. In that regard, the tariff war is a bust where the companies hit will be facing a rock and a hard stand on tariffs, this is shown by a few clever people to move part of their operation to Europe, and Harley Davidson is merely the first of several to make that move.

- China has options, this is the big one. The US blames China for flooding the market with cheap steel and aluminium and has already stepped up protective measures against Chinese steel products. In opposition, US businesses, including those in the car, tech and agriculture industries, are eager to get into the Chinese market, giving leaders there some leverage. So in the end, the tariff war is not strangling US businesses to fan out to the Chinese market, as exemptions are gained here, the tariff war becomes close to pointless and it merely drove down the economy. This last part is not a given and cannot be proven until 2019, which could null and void any chance of President Trump getting a second term, in addition, if this is not going to be a slam dunk win for the Democrats, the Republicans better have a strong case, because 2020 is the one election where the chances for winning by Jeb Bush (Florida) and Ann Coulter (Florida) seems to be a better option than re-electing the current president. Who would have thought that in 2016? It becomes hilarious when you consider that 2020 is the year that Marco Rubio declined to run, only to give the presidency to Ann Coulter. My sense of humour needs to point that out, whether it becomes reality or not.

The previous part is important to consider, not for the matter of who becomes president, but the setting that the economy is in such a state where we all see the proclamation ““Anyone who thinks the economy is being wrecked doesn’t know what they’re talking about,” Commerce Secretary Wilbur Ross said in a June 21 Bloomberg Television interview“. We accept the fact that he states that, yet everyone seems to overlook that the debt also gives an annual interest that is close to $100 per taxpayer, now consider that 80% of the population is in the 15% or 10% bracket. So from their taxation we see a maximum of $755 where 13% goes straight to the paying of the interest, when you are in the higher bracket 3% is lost. So before anything else is done up to 16% is lost and that accounts for 80% of the population, merely because no budgets were properly kept, the US infrastructure lost up to 16% straight from the start, that is the undermining of an infrastructure that also fuels the economy which it can no longer do. You see behind this is the IP, or as the US calls it the IP theft by China. I am uncertain if we can agree. I am not stating that it does not happen, I merely look at the Dutch examples from Buma/Stemra in the 90’s and their numbers were flawed, perhaps even cooked. They never made sense and after that we have seen ‘political weighting‘ of numbers that were debatable from the start.

So when we look back to 2017, we see the NY Times giving us: “Intellectual-property theft covers a wide spectrum: counterfeiting American fashion designs, pirating movies and video games, patent infringement and stealing proprietary technology and software“, yet I have seen these accusations in Europe and the numbers never added up. So when we see: “Central to Chinese cybersecurity law is the “secure and controllable” standard, which, in the name of protecting software and data, forces companies operating in China to disclose critical intellectual property to the government and requires that they store data locally. Even before this Chinese legislation, some three-quarters of Chinese imported software was pirated. Now, despite the law, American companies may be even more vulnerable“. It will happen, yet to what degree does it happen? What evidence is there? Consider the setting when we think of students. Students tend to have one of the harshest budgets to live on. Let’s take 100 students and they all decided to duplicate (read: borrow) the latest album from Taylor Swift ‘Reputation’ (it is easier to imagine it when the victim is a beautiful blonde who only recently stopped being a teenager). Now, basically she lost $2390 in revenue, yet is that true? How many would have actually bought the album? Let’s say 10% of all students are real fans and they would have bought the album (when not confronted with the choice of food versus entertainment), so the actual loss is $239. Now, this is still a loss and she is entitled to take action here. Yet the people making a living in the facilitation industry will demand the loss be set to $2390 that is where the numbers do not add up! There is the setting of eagerness to hear an album versus the need to have the album. We are all driven with the need to hear the album and some will buy it. This opposes several views and whilst the implied copied work allegedly is done so in the hundreds of thousands, the evidence is not there to support it. That is where weighted forecasts are the setting and it is an inaccurate one. So in all this, from the IP point of view, do we have 23,675,129 C# programmers, or merely 24 million people who wanted to take a look at C# only to install it and never use it because they could not figure out what they were looking at?

Now we get to 2018, where we see (at http://money.cnn.com/2018/03/23/technology/china-us-trump-tariffs-ip-theft/index.html) the projected issues with “The United States Trade Representative, which led the seven-month investigation into China’s intellectual property theft and made recommendations to the Trump administration, found that “Chinese theft of American IP currently costs between $225 billion and $600 billion annually“, I wonder what numbers they are set on. Now we can agree that the likelihood of “”China has sought to acquire US technology by any means, licit or illicit,” James Andrew Lewis, senior vice president at the Center for Strategic and International Studies in Washington, wrote in a blog post Thursday” being true in regard to defence projects would be high. Yet in all this, where is the data supporting these views? Without proper data we are faced with US companies setting expected revenue that is many millions too high and that part remains unanswered on many fronts. Now in defence, we get it! That is the game, so as we consider the news last year from breaking defense with the news that: “compassion for the Army, which is trying to standardize its computer systems across more than 400 units in the next 28 months. The objective is a “single software baseline,” where every unit has the same set of information technologies. Such standardization should simplify everything from training, maintenance, operations and future upgrades“, this is fun to read as I had to set up something like that for a company much smaller. There we learned that Dell was kind enough to have within two shipments the same model computer yet both had different patches because one chip had been changed. Now consider that this ‘unsettling dream of standardisation‘ was for a company with hardware usage merely a rough 0.13% of what the US Army has. So, that is something that will bite them soon enough. This doesn’t make the setting smaller, but a lot larger, the wrong patches tend to open up networks for all kinds of flaws not correctly set. So the cyber intrusion setting would be an optional 300% larger, giving a much larger success rate, all people willing to sell data to the Chinese (or the Chinese merely enticing the American people to embrace marketing capitalism for their own gains).

To explain the previous part in its proper light we need to realise. It is not merely about IP theft and rights; it is also about common cyber sense. In both the military and corporate setting there is a need for levels of standardisation, whilst IP that tends to rely on standardisation to be more successful, the IP theft setting is actually opposite to that. The Conversation (at http://theconversation.com/three-reasons-why-pacemakers-are-vulnerable-to-hacking-83362) gives us when they look at the medical dangers. As they give us Power versus security as well as Convenience versus security we see the first dangers. So consider the following. First there is “according to Carnegie Mellon researchers, can increase the energy consumption of some mobile phones by up to 30% because of the loss of proxies“, then we get “Most embedded medical devices don’t currently have the memory, processing power or battery life to support proper cryptographic security, encryption or access control“, giving us that hacking into someone’s pacemaker is actually not as hard as one might think. Now consider that encryption, or a lack thereof can be found on a large variety of IoT devices, and any army has their own devices that need to be more accessible at all times. In the second consideration we get “The prospect of having to keep usernames, passwords and encryption keys handy and safe is contrary to how they plan to use them“, as well as “When your pacemaker fails and the ambulance arrives, however, will you really have the time (or ability) to find the device serial number and authentication details to give to the paramedics“, it is the age old setting of convenience for the safety of all. So as we realise this, how much IP theft was already available before anyone realised its need? It is almost like the gun laws in the US, everyone wants gun laws whilst there are millions available for unmonitored purchasing defeating the purpose altogether. In that same setting we ignore common Cyber Sense too often allowing for IP theft on a much larger scale. The issue is that it does not mean that this is actually happening, or that others have interest to steal that particular IP. So we can optionally agree that the Chinese government that they definitely want all the IP on that front, even as some sources state that there is still a problem. So when we consider to an example, we need to look at that part of the information came from a research report by LtCol B. L. Ream, USAF, which gives us “There are two types of guidance systems available, the AGM-65A/B is optical guided and the AGM-65D model Is Infrared guided“, as well as “Once launched, the missile maintains a lock on to the target and guides autonomously, providing a standoff launch and leave capability. The aircraft can then egress the target area or set up to fire again in a target rich environment“, yet the other undisclosed source gives us that a programming issue on the locking when it is set through a buddy system. The: “data link control of the weapon can be provided from two different sources. Either the launch aircraft can guide the weapon or a buddy aircraft can control the weapon after launch. In either case, data link line of sight must be maintained between the data link aircraft and the weapon. Thus, on a standoff control scenario, the further away from the target the control aircraft is the higher altitude it must maintain. Even though this may not appear to be tactically sound, the standoff range is impressive“, so the undisclosed source that gives that the Data Link has a match issue and there is a chance that the speculated offset of 35 metres is ‘accidently implemented on targeting‘, will there be an issue of IP theft? When materials are openly available on the internet, as I was able to read the report on the Defense Technical Information Center site. When is there a case of IP theft? In this I love the reference that WIPO uses. Here we see: “Copyright protection extends only to expressions, and not to ideas, procedures, methods of operation or mathematical concepts as such“, considering that ballistic software is 90% math (read: the application of mathematical concepts), copyright as an option goes straight out of the window, in addition, the data link adjustment makes it in theory a new product that was not covered in the first place. So standardisation makes it easier to get to the lollies, and by adjusting the wrapper it ends up not being IP theft, as long as no trademarks reside on the wrapper (a ‘it is more alike than not‘ issue in IP law).

And now for the main meal

This is seen in the CNN article I raised earlier. The headline ‘President Donald Trump has slapped tariffs on $50 billion worth of Chinese goods, taking aim at China’s theft of US intellectual property‘. It was and has always been about IP protectionism. Business Insider gives us “Two former senior Defence Department officials said Chinese intellectual property theft cost the US as much as $US600 billion a year, calling it possibly the “greatest transfer of wealth in history.”“, the Financial Times (at https://www.ft.com/content/995063be-1e0a-11e8-956a-43db76e69936) gives us: “as Chrystia Freeland, Canada’s foreign minister, suggests: “It is entirely inappropriate to view any trade with Canada as a national security threat to the United States.” Yet once this loophole is used so irresponsibly by the US, of all countries, where might it stop?” The Financial Times takes it a lot further giving raise to the question how did it in the end serve IP? Where we saw more than once the terms ‘as much as $US600 billion a year‘, yet no evidence is presented. There is no setting that ‘Two former senior Defence Department officials‘ can present a list adding the numbers up and with $600 billion in the balance (as opposed to the commercial industry) we see that if proper evidence was presented a better case could have been made. Where we see in opposition to China: a lucrative market in designer knockoff goods in places like Amsterdam and London. London getting its share of 17 million tourists, all happy to get the latest Gucci bag for a special discount price of £19.95 as well as in Amsterdam where the 14 million visitors can get them for a mere €25. So did Gucci report a €812 million in IP theft losses? What about the other brands? I was the proud owner of an Australian Polo for $12, I merely needed a polo shirt (many years ago) as some drunk blonde thought it was perfectly normal to dance in high heels in the middle of the road holding a glass of red wine, so as she jumped to get away from a car (who had an actual reason to be on the road), I ended up with her wine on my shirt. So I got to the first place that sold a polo shirt and got a new one so I would not arrive at a diner red stained before it even began. Did I initiate IP theft? I had no idea what ‘Australian’ was in those days. There is the setting, what we know, what was real damage and how it is presented by those needing inflated IP theft numbers?

It is in this setting that we need to see the stage for reported IP theft. We agree that the smallest fraction is indeed set to the covert acquisition of military IP, yet the bulk (well over 95%) is all about a misrepresenting economy, the brands want their losses to seem as large as possible, the US is setting that stage to prospective economic health, yet that evidence cannot be validated and the tariff war is likely to become a much more detrimental factor in the US economy that is currently presented as a revenue bubble that will impact sooner rather than later. The independent gave us last December (at https://www.independent.co.uk/voices/economy-signs-interest-rates-donald-trump-market-bubble-burst-next-year-a8102356.html) that ‘Five economic signs that can tell us if the bubble will burst next year‘. Here we see “The good news is that the world is at last experiencing a coordinated expansion, with all major regions growing reasonably swiftly“, as well as “the policies that have led to this expansion, especially ultra-easy money conditions, have created a boom in asset prices that at some stage will come to an end“. There are a few views in all direction, yet the one that no one seems to focus on is the quality of life. Earlier this year USA Today reported that “California has the worst quality of life in America“, the sunny state is where people can no longer afford to live to any decent degree. That part is forgotten, the QoL in New York is in 25th position, not a great place to be. The Quality of Life in the US has decreased to the degree where it is the lowest in the developed world. That and the fact that the US is at minus 21 trillion does not help. It is shown in the US Social Progress Index where none of the five largest state economies (California, New York, Illinois, Florida and Texas) are in the top ten states on social progress. This is important and reflects back to the student example I gave earlier. So as these people will all ‘borrow’ the latest Taylor Swift album and none of those will buy it, because they cannot afford to do so. That part becomes even more visible when you consider the Wired setting on pre-owned games in 2016. At some point Microsoft made the terminal choice as given by Wired through “You may remember that Microsoft attempted to do away with “used games” with the launch of the Xbox One. (Yeah, they made some hand-wavy claims of players being able to trade games at “participating retailers,” but the DRM scheme meant you couldn’t borrow, lend, sell them on eBay“, that setting is merely exploding in an economy that is not moving forward. That with 80% of the people on merely a 15% tax bracket or lower and the cost of living there is still going up. Even as Microsoft is pushing to “buy at the Microsoft store“, a digital copy cannot be handed out to friends, so there is little push for that move when you can only afford 4 games a year. However, Microsoft is in equal measure pushing for the Game Pass which balances one for the other. EA is making a similar move and it is actually an intelligent move to make. The few that would buy the latest NHL version no matter what gives is nothing compared to the overwhelming group that will happily buy the previous year version when it is part of a package deal at $40 a year. So I might wield the latest NHL version, at $40 a year getting the previous season of FIFA, NBA and NFL is just smart thinking. Yet these people are equally part of the claimants of IP theft. The question becomes (even as we accept that it will happen), how large is the actual IP theft? So when the US adds a 10% tariff on video games, does that merely make the download 10% more expensive? I do not think that from $40 to $44 for EA games is an increase we lose sleep about, yet the ‘cost’ of downloading remains as well, and in the flawed Microsoft design, how does the tariff apply over time, on DLC and other elements in gaming? All these changes and increases, where the consumer sees no upside, all based on projected and presented numbers without its proper representation and scrutiny.

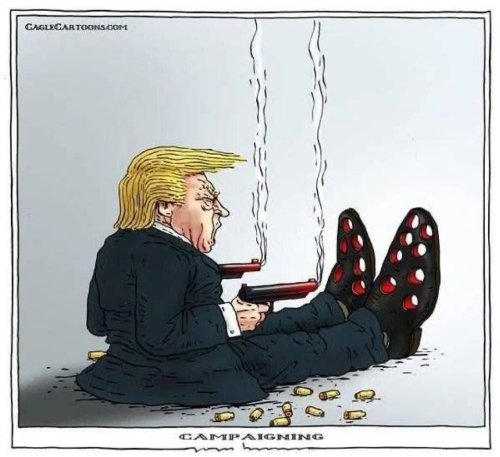

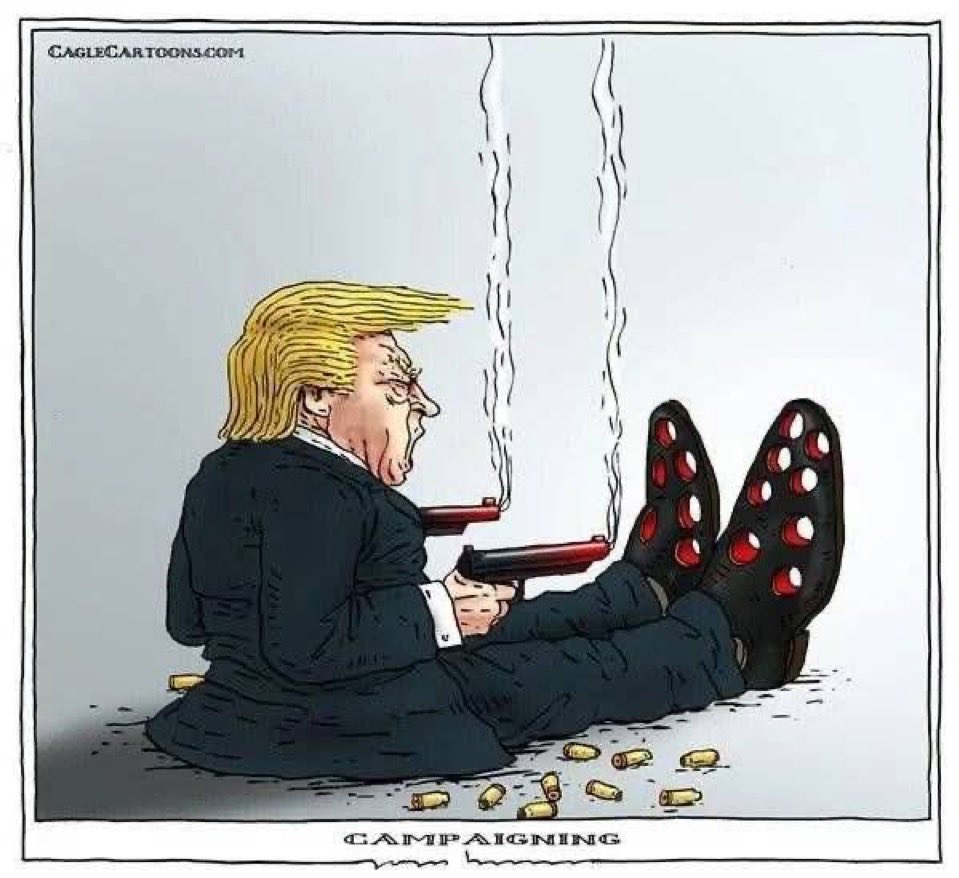

This is how an economy goes the way of the Dodo, so when you think (source: Sydney Morning Herald) that the start of ‘US plans to curb Chinese tech investments, citing security‘ is a good idea and it is waxed with “the White House would use one of the most significant legal measures available to declare China’s investment in US companies involved in technologies such as new-energy vehicles, robotics and aerospace a threat to economic and national security, according to eight people familiar with the plans“, we need to see in equal setting the fact that 750 million Europeans might find the escalation of events important and threatening enough to take a 180 degree position on tech operators like Huawei when we are treated to “Huawei, China’s biggest maker of handsets and networking equipment, which has been flagged numerous times by US lawmakers as a possible security threat to Americans. Upon the New York Times’ publication of a piece (paywall) highlighting Facebook’s data sharing with Huawei, as well as with three other Chinese companies, the social network told the paper it would wind down (paywall) its partnership with the Shenzhen-based phone brand“. One side tries to stop and filter, whilst the other side turned open the tap and let the room flood. Even now, after a congressional hearing and the Cambridge Analytica events, we see alleged transgressions and the sharing of data on a stage where we see only growth. With “Due to the importance of highlighting the natural and heritage landmarks in the Kingdom, “Huawei Saudi” joined together with Qumra’s community of photographers to organize a workshop around “photography through smartphones” by using the latest “Huawei P20 Pro” phone” and the setting that offers the latest in mobile technology far below the prices that Google, Apple and Samsung have. It does not matter on how the tariff war is to become a disaster, it is the mere realisation that it fails because those implementing changes do not seem to comprehend that the economy consists of well over a billion consumers and they cannot afford the 10% more or the 28% more expensive mobile phone alternatives. In all this the people confronted with the dilemma merely went directly to the consumers, as such Harley Davidson is moving to Europe to circumvent a few barricades, a tariff war that was short sighted to a lot of people more intelligent than me and the country that considers naked short selling to not be illegal seems to be doing just that to its own economy, how is that the setting of morality of capitalism?

We consider the way of the Dodo and realise that in the end it merely tasted like chicken.

#HowSmartWereWe or is that #HowSmartHuawei