So, after we see the events in Tesco, which has taken its billions in toll from September 2014 onwards, we now learn that Japan has its own version of Tesco, which we read in ‘Toshiba boss quits over £780m accounting scandal‘ (at http://www.theguardian.com/world/2015/jul/21/toshiba-boss-quits-hisao-tanaka-accounting-scandal).

Here it is not the meagre 263 million that Deloitte discovered would only be the tip of the Titanic sinker, in the case of Japan, it is three times the amount, which initially might beckon the question whether the fall out for Toshiba could be 9 times worse. Is it that simple?

The Guardian gives us the following “Tanaka and Sasaki knew about the profit overstatement and created a pressurised corporate culture that prompted business heads to manipulate figures to meet targets, the investigators found“, the other one is “Improper accounting at Toshiba included overstatements and booking profits early or pushing back the recording of losses or charges. Those actions often resulted in still higher targets being set for business divisions in the following period“.

These two are aimed at one side of a picture, but what some sales people will know is that this is already a disjointed part. Before I go into this, there is one more quote that needs to be mentioned. It is “Despite its shares losing almost a quarter of their value since the irregularities surfaced in April, it is still Japan’s 10th biggest company by market value. It was created by a merger in 1938 but its roots date back to 1875 and it was one of the companies that turned Japan into an industrial power“, so these irregularities have been part of something already for months, in addition, from an article one day earlier we get “The report said much of the improper accounting, stretching back to fiscal year 2008, was intentional and would have been difficult for auditors to detect“.

The last paragraph alone implies that like with Tesco, this system could not be done without massive ‘support’ from accountancy firms, moreover in all this, we have to wonder if anything will be achieved, especially as PwC (Pricewaterhouse Coopers) seems to have fallen off the view of journalists, and as we have seen no news from the SFO (Serious Fraud Office) since December 2014, we can ask in equal measure, whether the now sparkly news on Toshiba will go anywhere at all. Is it not interesting that PwC added 64 new partners three weeks ago, they get all the limelight as we read “Luke Sayers, chief executive of PwC Australia, congratulated the new partners on their appointment, praising their outstanding professional expertise“, whilst at the same time we get “IOOF has hired accounting giant PwC to review its regulatory breach reporting policy and procedures within the firm’s research division“, whilst in all this, PwC should still be regarded as the number one problem, as for a long time Tesco’s ‘issues of monetary matters‘ ended up getting overstated by well over a quarter of a billion, and so far it seems that either the SFO is nowhere, it is hushed or it seems to pussyfoot around PwC as the PwC marketing engine goes on like there was never a glitch in their seamless sky to begin with.

Now it is important that the entire PwC issue hits the UK, so a global company like PwC should not get hindered by one rotten basket, especially as they have dozens of baskets. Yet as one basket was regarded to have gone ‘rotten through’, the fact that there remains a system of silence, gives way to ask the question why PwC should be trusted at all and in that light, in the case of Toshiba, how intensely damaged the accounting business has become, you see Tesco and if we go by the words of Sheldon Ray of the Financial times we see “non-GAAP earnings per share that were more than 100 per cent higher than its GAAP numbers in the last quarter. Another reported 2 cents a share non-GAAP profit vs $1.41 per share loss under GAAP in one quarter” (at http://www.ft.com/intl/cms/s/0/f07720d4-c9b1-11e4-b2ef-00144feab7de.html#axzz3gWXJGSSF), so how deep goes all this? This grows in light when we consider ‘Richard Bove on Fannie Mae’s Accounting Irregularities‘ (at http://www.valuewalk.com/2015/07/fannie-mae-accounting/). Not a number one source, yet consider the quote “The result of their work is a conspiracy theory concerning the government takeover of Fannie Mae in which the public has been lied to concerning Fannie Mae’s financial condition in 2008 and in subsequent years“, this is linked to the work by Adam Spittler CPA, MS, and Mike Ciklin JD, MBA, MRE. Spittler is a Senior Associate at KPMG and Ciklin is an investor in a number of start-up digitally based companies, so we see that there is at least some Gravitas with these people, now add to that the information from the Washington Times (at http://www.washingtontimes.com/news/2015/mar/11/fannie-mae-recklessness-risks-future-financial-cri/), where we see ‘Mortgage giant hired unqualified auditor with conflict of interest for critical position‘ and “Nearly seven years after it was bailed out from the housing market crash, mortgage giant Fannie Mae is still engaging in behaviour that could precipitate future financial crises and taxpayer losses, a government watchdog warns in a report to be released Wednesday“, which was an article from last March. Now, the fact that this is not ‘new’ news is not the issue, what is the issue is that there is an almost Global act of blatant disregard, leaving the people the feeling that accounting seems to be set to levels of intentional misrepresenting companies for the need of bonuses and the ‘Holy Dow’. The fact that the activity against such transgressions is seemingly kept of the table in these economic times will only grow stronger unrest.

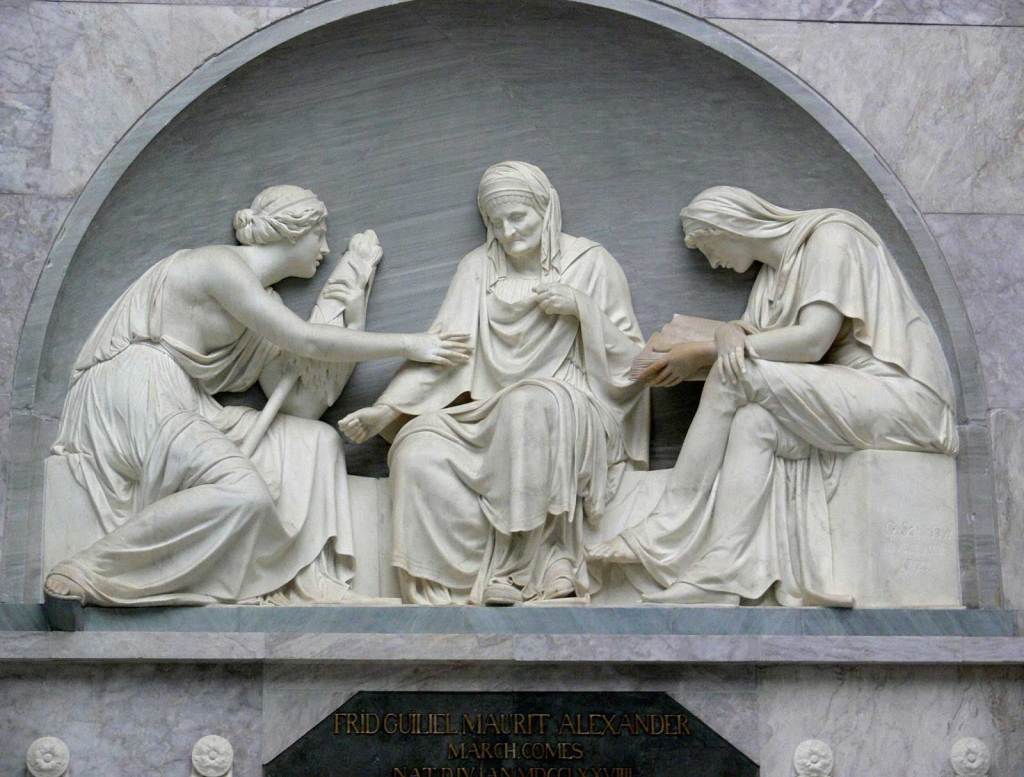

Yet, is my view correct, is it not me that is in error? Let’s face it, One in the US, one in Japan and one in UK does not a conspiracy make, it does not reflect on some non-existing criminal empire based on the quill, ink and parchment (as accounting used to go in the old days). What is an issue is how on a global scale governments seem to act or not act is matter for discussion, yet in all this external forces have been at work too, let’s face it that the US in 2008 was a place of desperation, even as it is now still on the ‘to-be-regarded-as-bankrupt’ even governments will make weird leaps when they are pushed into a corner. In my view, the fact that the bulk of global accounting is pretty much in the hands of half a dozen accounting firms remains cause for alarm and PwC is in the thick of many events. Including the 40 million property scandal surrounding Xu Jiayin last march.

Yet back we go to Japan, the land of yummy Sushi and as it seems shady bookkeeping. You see, there is no way to tell how deep Toshiba will get gutted, if Tesco is any form of indication, there will be a massive backlash, If 256 million leads to a well over 3 billion drop in value, what will it do to Toshiba? More important, with Japan so deep in debt, would it push Japan over the edge of bankruptcy? Let’s not forget that Japan hung over that Abyss a few times and the US seemed to have ‘intervened’ in favour of Japan in the past, in this case, that might not ever be an option again. For those who think that I overreact, think again. Tesco lost value factor 12. Now, we all agree that this is extremely unlikely to hit Toshiba to that degree, but what happens when stockholders walk out? Now consider that Toshiba is amongst the 10 largest Japanese companies with a global reach that equals IBM, that whilst Japan has a debt of $10 trillion, the fallout will hit Japan (again). To give view to the next part, I need to revisit a part I mentioned in the past. Let us take a look at the following example:

In week 10 a salesperson makes a sale, knowing it will not be a solution, during the next week that customer gets managed all over support and after a week, they escalate and communicate with the customer on solving it, a week after that the customer gets the apology that there is no solution, but that the customer will get a full refund, case closed.

Week 10 Sale made

Week 11 Support starts

Week 12 Escalation

Week 13 No resolution

Week 15 Refund

Now the part, the sale was made, in Week 13 no resolution, now we leave one quarter and go into the new quarter, the refund will not affect the sales person’s bonus, nor will the sales target be affected due to negative sale.

This is based on actual events, now think of the impact when this is not mere sales, but 1.2 billion in sales. Did this happen? I cannot state that all of the funds were done in that way, but consider the impact of increased sales and the people who enjoyed their bonuses from that (if that happens in Japan).

Consider the quote “blamed on management’s overzealous pursuit of profit“, which we get from the ABC article (at http://www.abc.net.au/news/2015-07-21/toshiba-top-executives-quit-over-us12-billion-scandal/6637976). Now add to that the quote “underlings could not challenge powerful bosses who were intent on boosting profits at almost any cost“, so how was the profit boosted? You see, this is not just an auditing issue, when we look at these large companies and the way that sales are arranged and forecasted, consider the events involved. To name but a few

- Leads

- Contacts (the consequence of a lead)

- Forecasting (the consequence of contact and the push for sale)

- Sales registration (Scopus, Salesforce, SAP)

- Accounting

- Reporting

Six iterations of paper and electronic trails that had to handle 1.2 billion in virtual revenue to some extent. Even if the leads cycle was avoided (by going through existing customers), there are other divisions that needed to be aware of a large non existing sale. You see, twelve hundred million dollars makes for a massive amount of monitors, laptops and other items Toshiba makes. Even over time, flags should have been raised on several levels, so when I read “The report said much of the improper accounting, which stretched back to 2008, was intentional and would have been difficult for auditors to detect“, which implies that the intentional misdirection was done over 6 iterations, which means that the group involved was a bit larger than we read in the articles at present. More important, how well did the Auditors seek in this regard? Which now takes me back to the reference I made earlier regarding “PwC added 64 new partners“, so how good are these ‘senior’ players? Making someone a partner, so that they can be misdirected by a senior partner would be equally disturbing. The fact that Toshiba falls through just like Olympus did, in a place where these events are regarded as ‘shocking’ according to investigating lawyer Koichi Ueda does not make me any less nervous. How institutionalised is overstating revenues on a global scale? You see, this is happening a lot more than many realise and even though many are not found, it does not mean it is not happening next to your own place of business. Now we get back to the issue I raised regarding Fannie Mae. The fact that it is not unrealistic that the government looked the other way here is still a fact we must consider. More important, are the two parts not mentioned in any of this. The first is linked to the issue I reported on January 30th 2013 (yes over 2 years ago at https://lawlordtobe.com/2013/01/30/time-for-another-collapse/) in my article ‘Time for another collapse‘, I questioned the way the Dow did not just recover, it did so whilst places all around us were remaining below par for a very long time after that. Now consider the following speculative theory:

What if places like Fannie Mae used the ‘leave one in’ approach. So there were mortgage packages and derivatives. So, we have four properties that are doing fine and we add one worthless one to the mix. The package deal as the salesperson states. So the buyer ends up with a ‘value’ and whilst one part is ‘given’ without value, that person has a good deal, now consider that this one place is no longer a lost place, it is no longer a write off. Over time the market would recover with less losses, so is this truly an action that is virtually impossible? Moreover, if such a thing truly happens, would it be fraud? How could an auditor ever find the event in the first place?

This now links back to Toshiba, not just in how you push up 1.2 billion, but how to get it passing the view of a ton of auditors. In the case of Tesco, I personally considered the involvement of PwC from the first moment the news came out, there it was a less murky place because as supermarket chain their product goes to Joe and Jolene Public. That is not the case with Toshiba. Not only are they global, but with a power plant division (including the one that makes you grow in the dark) as well as medical equipment (likely needed for previous mentioned division), Toshiba deals with consumers, corporations and governments, which on one side requires a lot more administration, but that administration would have the ability to go murky on an exponential level, which gives added value to the claim “difficult for auditors to detect” yet that gives option to two parts, is there a questionable level of administration, or are we confronted that the auditing partner in this case was a 28 year old recently promoted individual who now gets his/her first real large account?

Why these statements?

You see in all this, on a global scale, the law has failed. It fails because the rewards are just too good to pass up for those playing that game, the chance to get away with it and the option to keep at least a decent part of these earnings safe makes the option to do this again and again almost a certainty. The law has no bite and the corporations involved are too powerful to get smitten down, so this avenue will continue for a long time to come. In addition to this we ask what else is affected and why is there a tendency from the press to not keep these matters a lot more visible? Consider how much the Guardian and others reported in 2014, if you now Google ‘PwC Fraud SFO Tesco‘ we get nothing after December 22nd, what a Christmas present that is! What is funny that one other part showed up, which is Keith McCarthy, now director at PwC London, who was Chief Investigator with the UK Serious Fraud Office before that, so would it be mere speculation that the best way to avoid prison is to hire the police officer so you know where they will be looking? #JustAsking

I am only asking!

Anyway, with a wish for a better lifestyle, I will consider helping Toshiba to retrench their IP and Patents for a mere 0.4% of the value, now if I could only persuade my Law Professor to help me out, 0.3% for her and 0.1% for me, I should end up with enough to buy http://www.cooperbrouard.com/St-Peter-Port/Ridge-House-property/3835453 and retire in a relaxing way!

I agree that I could do better, but then I was never a greedy person, which is a failing the Toshiba executive clearly lacked.