Yup, I have had enough of the presented media on how Canadians are not that much of a bother to America’s tourism setting. And for this I put attention on Now Toronto as we take a look at their side (at https://nowtoronto.com/news/are-toronto-residents-skipping-u-s-travel-heres-what-theyre-saying/) where we see ‘Are Toronto residents skipping U.S. travel? Here’s what they’re saying’ we are being told the first direct bullet points (a nice way of summary to the setting).

- A new Abacus Data poll found nearly one in four Canadians have opted out of traveling to the U.S. due to feelings about the Trump administration, a trend reflected in Statistics Canada data showing sharp drops in both vehicle and air return trips from the U.S. in late 2025.

- StatCan reported Canadian resident return trips by vehicle from the U.S. fell 28 per cent year-over-year in November 2025, while air travel dropped 12.1 per cent, even as overseas travel by Canadians increased 14 per cent during the same period.

- Some Toronto residents told Now Toronto they are intentionally avoiding travel to the U.S. for political, ethical, and economic reasons, choosing alternative destinations instead, with younger Canadians more likely to scrutinize peers who continue to vacation there.

Three points that make sense and that accounts for a lot more damage than anyone would have guessed at any point in time. I particularly like the ‘peer pressure’ point. It’s like a parent gets to hear ‘Really? There?’ by their 5 year old. A nice figment of my imaginary pressure seen on the inside of my eyelids.

And with the setting given at “Some Torontonians have told Now Toronto they’ve been boycotting travel to the U.S. in the time being. “I just feel like my dollar can be spent better elsewhere,” Olivia, a resident, said. “With all of the situation going on down there, I don’t feel like going.” Olivia said the decision to avoid the U.S. solidified in early 2025 as government policies and climate shifted. Instead, Olivia said she’s opting to travel to other regions.”

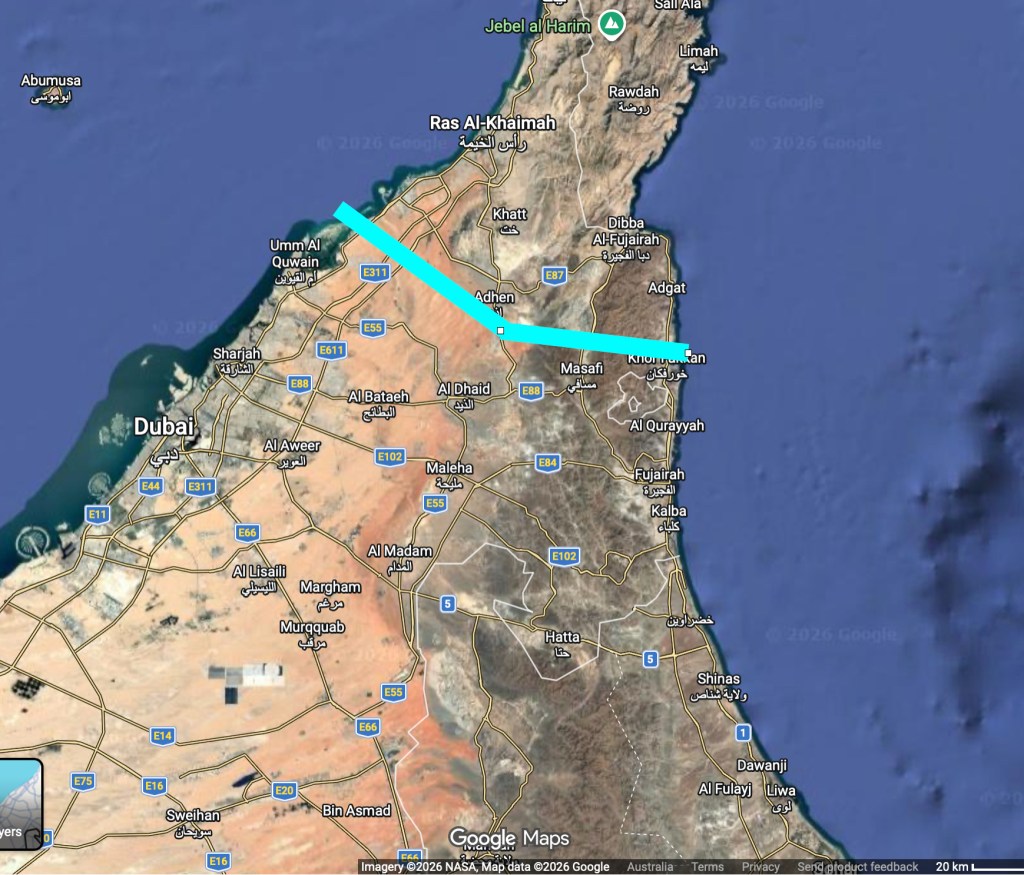

And it is this side that amounts to the bulk of other Commonwealthian’s who seem to decide on Abu Dhabi in the UAE over anywhere in the US where the vacation seems genuine and is also one of the safest places on the planet and whilst those are mere cost dressings, the food prices in America are getting out of hand and they are really fitting the budget aware traveller in Abu Dhabi, that is beside the other entertainment they have on one island and some hotels add entrance to one of these places every day for those staying in their hotels, as such we see benefit on benefit. So whilst the pressure seems to be adding to European places (like Euro Disney, Efteling and other locations) It seems that the pristine settings for Abu Dhabi is getting an amazing appeal and that is merely the first glance for a tourist. There is so much more to see and do in the UAE and now that Abu Dhabi is a mere 95 minutes from Dubai by train, that is a vacation that starlet tourist will wow for.

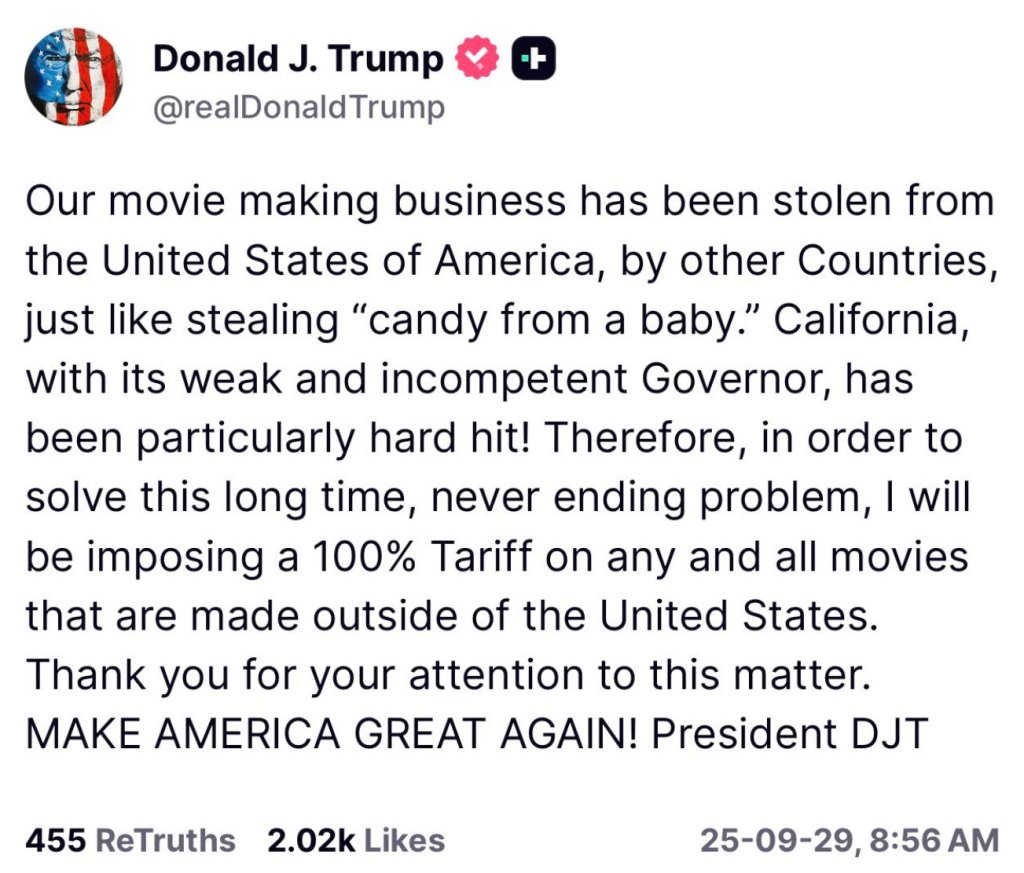

And whilst we still see “Olivia said she’s also more conscious of her spending choices, focusing on buying Canadian products to ensure she isn’t supporting the U.S. economy. Joel, a dual-citizen of both the U.S. and Canada says traveling there can be morally complicated. “Any political differences we have is outweighed by the fact that I have family there,” he said. “I have kids who want to see their aunts and uncles and cousins. Joel has noticed quite a difference in airport traffic in the last year or so when it comes to traveling south. “It’s faster at the border,” he said. “Because there’s no line-ups, there’s not a lot of people going.”” And as I see it, we are off to the races and as the UAE (Abu Dhabi) is erecting a massive Harry Potter addition to their Warner Brothers park, we see that also Disney is being added to Yas Island. As it is supposed to open in 2028, so there is time and there is already a lot to do, but these two players will undoubtedly become the death of American theme parks for many Canadians and now that they have an alternative, I reckon American tourism will get rightfully ignored by its northern neighbors and whilst the Winter-geese might be forced to keep their places for now. It seems that Florida will have a cruel awakening in the period 2025-2029. As as another source gave us a few hours ago that ‘Florida wants to win back its Canadian tourists’ and as we are given (at https://www.orlandoweekly.com/news/florida-wants-to-win-back-its-canadian-tourists/) “Tourism leaders in Florida are reaching out to their Canadian counterparts as the U.S. has seen a travel backlash over the words and actions of President Donald Trump. As Visit Florida compiles 2025 tourism figures, the agency’s President and CEO Bryan Griffin and Carol Dover, the president and CEO of the Florida Restaurant and Lodging Association, are setting up a meeting with Canadian officials.” I’m certain that us useless as the settings of hardship were pushed through by Washington DC. So we might consider whatever we want but a vagrant in Orlando called Bumble Dora (I swear that was his name) waved a twig and whispered ‘Canadia Phohibitus’ as such Florida might wish for whatever they want, but foreign policy was dictated to all by Washington and everyone decided they have hd enough of America in that setting and when you consider what the UAE offers and what America doesn’t (or no longer) offers that reality is setting in for global tourism. So when we get the ‘presented’ “In December, Visit Florida estimated 34.339 million people traveled into the state between the start of July and end of September, up from 34.239 million during the same third quarter period in 2024. The numbers showed slight year-to-year growth in overseas visitors and domestic travelers.” You know that you are being presented a gamble with loaded dice and I reckon that not merely the Canadians have had enough of that. Consider the video that we are given (at https://youtu.be/hkr0WfTufJo?si=4gSmVZ9riFvUobmz) and the empty corridors and plane. As such a mere 100,000 less tourist is a BS setting that we are given, all whilst several sources are giving the world that the United States is getting hit by $12.5 Billion lower revenue. I think that they are off by well over $30 billion more than that (for settings that suddenly no longer matter), all whilst they were used to pump up their views when it dod matter. So whilst we understand that Florida is trying to save what it can, but to give it that swing whilst we see videos all over YouTube and TikTok appear of an empty Orlando International Airport (MCO) is not the way to go about it, but that might merely be my dubious view on the matter.

But now we get to the data that I didn’t know about. We are given “Abacus Data also reported that 33 per cent of Canadians would think less of peers who continued to travel to the U.S.

The data suggested the likelihood of those polled who would scrutinize anyone traveling increased the younger the person was. “Nearly half of those aged 18 to 29 say they would think less of someone close to them for vacationing in the United States,” Abacus Data stated. “That drops among those aged 30 to 44, falls further among those 45 to 59, and remains lower among those 60 and over.”” So consider this setting with University students, as I see it, that will stop people from traveling towards the United States in plenty of ways and whilst Toronto, Vancouver, Ottawa, Calgary, Edmonton and Montreal all have their own Universities, I reckon that they will stop a lot more than currently seen. Consider that any shop would have to admit that they went to the United States for a vacation. They would lose so many customers in the blink of an eye. I reckon the hardship of Florida is merely just beginning. And with every event where President Trump opens his mouth, that hardship merely increases. Don’t take my word for it, but it seems that someone named Elisabeth Booth will do something about that really soon. No idea what she is inferring but I reckon she knows best (or at least I hope so).

And this setting is not merely apt for Canadians. I have heard similar settings in Sydney, we tend to support our Canadian brothers (sisters too). So we are also looking at places like Abu Dhabi and Europe. And whilst we are given “Australians can travel for short trips, without a visa, to the Schengen area for up to 90 days in any 180-day period” and as I see it, I don’t know any vacation that ever goes beyond 30 days and set against that “U.S. nonimmigrant visa fees for 2026 generally cost US$185–$315 for tourist/student visas and A new $250 “Visa Integrity Fee” is expected for many nonimmigrant visas in 2026”, so free or a VISA well over $565 dollars? Yes, I’ll take the non-US option too. For the record a tourist visa for the UAE costs $150, a simple setting where the USA priced themselves out of a market who needs to stop costs in this hard driven economy. A setting that is now hurting the settings of the United States to well over 2029 air present. I reckon that vacation in the United States are done for until long after 2029, because when the first stories come into the many destination on how their vacation to Abu Dhabi was ‘magical’ the hesitaters will come running and that will bring serious money from every other place towards the UAE and not towards the United States. Seems simple, doesn’t it?

Have a great day today.