That is the setting I saw mere hours ago. Should you think it is all a ‘fab’ you might be right. I haven’t ben able to verify this, but the setting is too large to explain in mere thoughts. You see, the story starts with ‘The US Should Reconsider Its AI Chips Deal With The UAE’ (at https://www.eurasiareview.com/22102025-the-us-should-reconsider-its-ai-chips-deal-with-the-uae-oped/) where we are given “In October 2025, the U.S. government granted Nvidia the export license to ship tens of billions of dollars of cutting-edge AI GPUs to the UAE, the deal was finally agreed upon after long debate about its impact on the U.S national security, because of the fear that these chips could be leaked to China, and was also surrounded by a controversy of the UAE using its financial networks to influence Trump to move on with it.” I personally think it is a silly setting, but who am I? But that wasn’t the whole story, it is ‘enhanced’ with “Given the UAE’s poor human rights record and its destabilizing role in the Middle East, it poses serious risks when providing it with this powerful technology. It’s morally imperative for the U.S. to reconsider this deal and place limits on it to ensure it will not be utilized to harm innocent people.” Huh? Poor Human Rights? On what evidence? The UAE is one of the safest countries in the world. Tourism is at an all time high and crime is at an all time low. We are given these settings as there are accusations against Sudan as per 2023 and at present no evidence has been given, the media seems to love the HR records, but it is nearly always devoid of factual evidence.

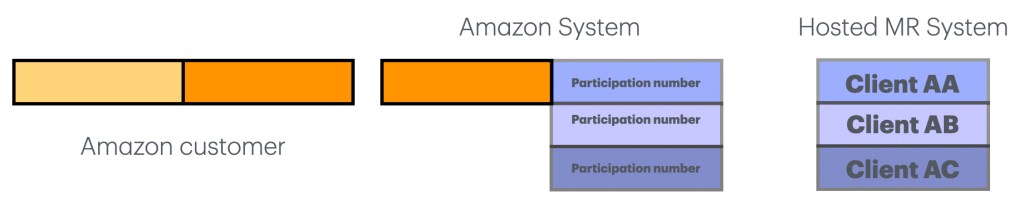

Yet the overwhelming abuse (by America) is shown with “While the deal makes it clear that these chips will not be handed to the UAE but will be operated by U.S. companies that have data center in the country, the U.S. should still ensure that this deal—aimed at helping the UAE establish the largest AI campus outside the United States—does not contribute to further human rights violations or war crimes. To prevent misuse, the agreement should include binding conditions prohibiting the use of U.S.-supplied chips in developing AI systems or military technologies for unlawful or unethical purposes, and in particular, blocking the reach of this technology to the UAE’s allied militias. Furthermore, an independent oversight mechanism is urgently needed to monitor compliance and hold the UAE accountable to these standards.” I have a problem with “to further human rights violations or war crimes” so what EXACTLY is America thinking it is doing? As I see it, America is setting up dat centers in the UAE, letting the UAE pay for them whilst they are American ‘Data Forts’, so at what point will people consider that America is selling the UAE an Edsel? And what about that (so called) “independent oversight mechanism is urgently needed to monitor compliance and hold the UAE accountable to these standards” There is something amiss in this equation and I am not sure if I can stomach such activities (especially as America is currently trying to annex Canada) then there is the deployment of national guards all over America as well as deploy ICE like bank robbers going at their own population. So where is the Human Rights watch in this setting?

So as I see it, the following passage should be read ‘differently’, it is “AI chips are considered essential hardware for training AI models and conducting research in the field of AI. Previously, the U.S. adopted the AI diffusion rule, balancing national security and human rights, and placed strong restrictions on exporting chips to countries with poor human rights records. This rule, which was previously rescinded, is not included in the recently issued America First AI action plan.” As I personally see it, the setting of “AI chips are considered essential hardware for training AI models” which is a truth, but the lager setting is that this so called training data requires verification and at what point is this data ‘accidentally’ transported to America grounds? As I see it this UAE data is the property of the UAE, optionally set in UAE population or economic data. So what assurances does the UAE have that this data remains in the UAE? So whilst the UAE pays for it all, America corporations grow and handle more and more foreign data? No wonder Microsoft wants in (a speculative jab) and at present I see no handles on keeping the UAE data safe in the UAE and the setting of “the Abu Dhabi-based sovereign wealth fund with over $280 billion, and G42, the AI hub founded in 2018, owned and chaired by the National Security Advisor of the UAE, Tahnoun bin Zayed Al Nahyan, who is also its controlling shareholder” does not inspire confidence in this setting. This is not in any way a reflection on Tahnoun bin Zayed Al Nahyan, but does he realise that the UAE data is the real treasure that America is speculatively after?

As I personally see it, the Human Rights part was part of the deception to put people on their defense and it has no bearing on the deal. There is even a ‘reference’ to a story in the Africa report and whilst were might take it seriously (you shouldn’t) the reference that “a private security firm based in the United Arab Emirates” with a simple setting pointing towards a passport stamp. Is that the foundation of this Mohamed Suliman? He might have an Engineering degree from the University of Khartoum, but the setting of evidence is as I (personally) see it rather alien to him. I blew that part apart in under 10 minutes and what does matter is that there are questions on what the UAE is allowing for and the fear that the stage of leaked to China is merely limited to the way America is conducting business. It should have China howling with laughter as it basically shows how desperate America has become. Just a small setting that is overlooked here.

As I personally see it, if it was about the UAE than the story would have reflected on how this IT dealer by the name of Larry Ellison (Oracle) had come to the UAE taking Tahnoun bin Zayed Al Nahyan on a personal tour of his AI Rolls Royce at 100 Milverton Drive, Mississauga (an assumed location where it could be held), did this happen? The story does not show this, and it neither show what AI settings were shown (a prerequisite that an AI engineer) would cherish, none of that. A mere dubious Human Rights setting, a setting that might have been left to a non-engineer.

So whilst we like to mull over the stage of “could readily be transferred to support its regional allies and militias to wage more wars and massacres” all whilst China is already decades ahead of others and it could not be served with evidence, merely assumptions. So did I give you enough food for thought? So what does this story serve? As I see it a lot of references without evidence of the level it might require. The only thing I see is “operated by U.S. companies that have data center in the country” so at what point are the needs of the government of the UAE being served? Especially as it is handed to us with the $280 billion price tag, but how much of this setting is actually charged to the UAE? Even that is missing, so what are we supposed to think?

Have a great day and consider that American coffee is optionally served in the UAE with a massive markup.