That is what I am looking at, the price of debt. You see, they are all hailing that the US economy is strong. One voice (Goldman Sachs), the one that lost it all in 2007 told the world that America would be strong at 2.5% (somewhere I read it). To all it sounds nice and I like nice, but I also query a system that is to my (non-economic view) is rigged. As we see images all over the place on how good things are supposed to be, consider:

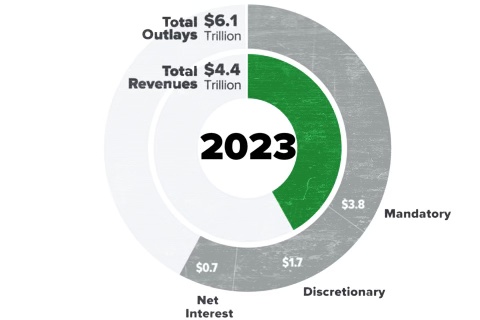

We see the setting as tax collected. For 2023 is was “The US government collected nearly $4.7 trillion in gross taxes during the 2023 fiscal year, which is a 15.5% decrease from 2022. The IRS collected taxes from a variety of sources”, now for some it is a little more then milk money. And that sounds nice, but the other side has “As of October 2024, the United States government’s monthly interest rate on its debt is 3.3%. The average interest rate for 2024 is 3.32%, and the total debt is $35.46 trillion.” Consider the simple setting of 3.32% of $35.46 trillion. This gives us $1,170,180,000,000 dollar annually. Which would be ‘liveable’ were it not for the simple fact that this is ONLY interest. The debt remains. And now we have a problem. You see the interest is is a simple 24.89% of the entire taxable revenue and it was 15.5% less from 2022. Do you now see the problem? 25% of all taxable revenue goes to the banks that carry the debt. The federal government spent $6.75 trillion in FY 2022. This means that they spend over 30% to much, more than they had and if there was no debt we could argue, but at this setting we are faced with the simple fact that $6.75 trillion was spent over an available amount of $3.5 trillion, which is getting worse and worse. As such we could surmise that the debt will increase with a little over 3 trillion over spending over last year alone. As I see it America is done for. And the setting worsens with the optional crushing of Google in 2025 (by breaking up that firm) which give Huawei their first global win. Then the defence industry is losing more and more revenue to China and this sets a larger premise. In that setting we see on one hand “The A&D industry generated $425 billion in economic value, representing 1.6 percent of the 2023 nominal GDP in the U.S.”, yet in this we already seeing revenue shifting to China in this year alone and more revenue goes to Europe. For Saudi Arabia alone this sets the bar at “In 2024, the Saudi Arabian defense budget is worth $71.7 billion and will grow at a CAGR of more than 8% during 2025-2029.” Yet other sources give us that “Saudi Arabia estimates military spending will be 15 percent lower than budgeted this year” as such we could surmise that this implies that Saudi Arabia by itself would spend $10 billion less. Not a biggie you say, but the other side is that China now has a little over 10% on that slice of delicious gunpowder baked pie. Making the loss for America more. As such we see an annual loss of $16 billion in one year alone from one customer. As such, what would be the books on India, Japan, Taiwan, Pakistan and Indonesia? If we see these picture, we see a dangerous escalation towards some fictive nil revenue for America. Fictive because that will never happen, but as the largest players seek economic stability they will spend less and take other jobs ‘in-house’ as the expression goes and America has been too reluctant to appease to that state of mind. And now China will step in to offer just that. As I see it, the question on the dollar setting was wrong. We are given “As of March 2024, over half (52.9%) of Chinese payments were settled in RMB while 42.8% were settled in USD” against the tariffs threat by president elect Trump. The actual question would become “How long could the US Dollar keep standing?” You see, as the debt becomes a millstone around the neck of the US administration, we need to consider that some nations will seek shelter from the fallout that this setting. In 2017, on March 17th I wrote ‘The finality of French freedom’ (at https://lawlordtobe.com/2017/03/17/the-finality-of-french-freedom/), I set the comparison of the Euro like a barge kept in balance by 4 strong economies. UK, France, Germany and a combined economic anchor. The UK was lost and there was a setting when the French anchor would be lost too. The Euro could not survive a setting with two anchors. A simple equation. Now with the Dollar under attack the Euro could face near certain scuttling. As such the Dollar has an influence there. China seemingly doesn’t care, but the other players who make up a combined anchor might switch sides when they merely look at their own currency. And the debt? They will not care. And as such the dollar faces a lot more than the bully tactics of choice. They will need to up the game by a lot, because when one goes, so will the other and that puts the livelihood and liveability of 784 million people at the markers. 100,000 of them will do fine, but that represents a simple 0.01275348% of people who are likely to make it (outside of the EU and USA), so when were that good statistics?

The price of debt was always there, but the media has been eager and willing to hide those facts through BS and spin and soon when the people catch on (the other 99.987% of people), the live of playing the media courtesan will be one of the most dangerous of them all. People remember. And it was a simple equation for the media. “You can fool all the people some of the time, you can fool some of the people all of the time but you can never fool all of the people all of the time” A simple setting I knew to be true as early as the early 80’s. So how long did they have at most? Some are already falling in the bad light and when the people realise that they weren’t eating potatoes, but turnips. They will become massively enraged.

A simple setting I have known to become reality at some point. So when are we given the goods? When the interest of the debt of America is shown as a setting against the budget and at this time it is around 25%, Americans need to realise that budgets need to diminish by at least 30%, so at what point do the people realise that the simplicity of the matter is that their money is about to be gone?

Have a lovely day.