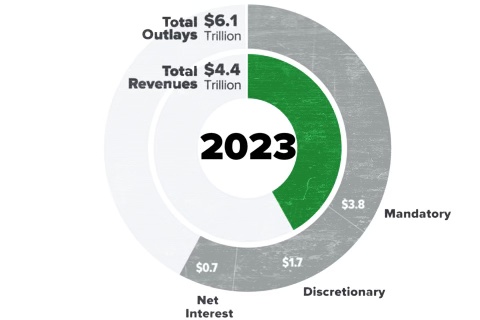

I have been sitting on a story for about three days. I have been hesitant as it is a field I am thoroughly unaware off, but it could hit me in the future and as we are given (at https://www.abc.net.au/news/2025-09-19/first-guardian-shield-collapse-asic-and-superannuation-flaws/105783328) the setting of ‘First Guardian, Shield superannuation disasters expose deep flaws in Australia’s $4.3 trillion retirement system’ we see that ABC is giving us not only cause for pause, but also cause for alarm we are set in a stage of almost desperate inability to protect our retirements. And lets be clear if Australia is set to a $4.3 trillion danger, what is the dangers towards America, Canada, the United Kingdom, France and Germany?

I tried to illustrate dangers like this in ‘Wages of fear’ which I wrote in May 2023, two years ago (at https://lawlordtobe.com/2023/05/02/wages-of-fear/) and there I wrote “Lets be clear, this was NOT his fault, but the point where we cannot avoid what comes next was achieved. If only people had woken up a lot sooner. But there we got past a point where the problems would accelerate and now we are almost at that point. And the banks will be no help. I tried to warn you a few times over. Some of their risk and liquidity is in US bonds and when the US forfeits payment your 401K and many other things will become worth close to nothing” Now the fair question is, is this the same? I don’t think it is, but there is a larger failing into the retirement systems as it is not a hands on pathway. ABC in another story hands us “Ms Wohlers is one of about 12,000 Australians haunted by the loss of more than $1 billion of retirement savings after the collapses of First Guardian and Shield.” As well as “ASIC deputy chair Sarah Court, who has commonly described the First Guardian and Shield cases as “industrial-scale misconduct”, says the regulator acted as soon as it could. “We don’t think we missed red flags,” she told ABC News ahead of ASIC’s appearance at a parliamentary hearing on Thursday, when she was grilled by politicians about whether it was a tough cop on the beat properly identifying financial misconduct.” And it relates to the story we are given with ‘140 targeted by ASIC on Shield, First Guardian’ as I see it, a mess of a disastrous kind. Where the latter gives us “So, for example, the financial advisers are saying to us ‘you can’t hold us accountable for this because the ratings house had rated the Shield Master Fund as of investment grade’, while superannuation fund trustees are telling us the same – ‘well, we relied on the ratings houses’, or ‘we relied on the fact that these members had financial advice’,” (Source: Financial Newswire) I see it as a setting where there is a ring setting with no beginning and no end. I am in a setting where Microsoft could steal my IP and my only defense would be to convict 280,000 Microsoft employees to death and kill them myself. I get that this is utter madness, but that would be the result of one party just playing a game with other whilst that party knows that they cannot be held to account. I remember the rating houses in 2008 and they got away whilst millions lost it all. I see the simpler setting “You take from me, I take from you” and the setting that Microsoft losing over 45% of its staff (I am utterly destined to fail) making it implode on itself. Now take that to the setting of rating houses and the the truth comes out (if it ever does) the people need to react and react harshly. It is not ‘business as usual’ it will become business at the cost of souls and that is a harsh reality to face.

So whilst some will lawyer up and that is their right, they should not be allowed to walk away with even a dime. I reckon that they will sue the rating houses and those rating houses will need to get sanitized (to some extent) because losing billions is a larger setting and when Australia with their billions in losses (up to 4,300 billion) the setting for America and Canada is a lot more severe. And America up to ten times as much as Canada faces. And about a month ago we were given ‘ASIC takes further action against Ferras Merhi over First Guardian and Shield superannuation advice’ where we are given “ASIC has sought leave from the Federal Court to expand its existing proceeding against former financial adviser Ferras Merhi to allege he engaged in unconscionable conduct, failed to act in the best interests of clients, gave conflicted advice, and provided defective statements of advice whilst receiving millions of dollars.” Yet my question becomes did Ferras Merhi do anything illegal? You see, in my setting I would be, but did he do anything illegal? The setting revolves around “provided defective statements of advice whilst receiving millions of dollars”, so what makes a statement ‘defective’? You see, I am not protecting Ferras Mehri. I am looking at the following:

s12CB of the ASIC Act – engaging in conduct in connection with the supply or possible supply of financial services, which was in all the circumstances unconscionable.

So, what makes the setting of “all the circumstances unconscionable” an economist looks at this in one way and I as a law graduate and IT technician in another way.

Then we get:

s952E of the Corporations Act – providing defective disclosure documents. As such, what makes the documents “defective disclosure documents”, I do not know and I look at them separately as that is what the law does and when merely one law falters, it all collapses (it matters later on).

Then we get:

s961B of the Corporations Act – failure to act in their client’s best interests, and what is that at the start? Most clients are ‘greed’ driven, they want the highest return and that is ‘their’ best interest. It is a hard lesson to learn that looking back the client gave the wrong advice to the advisor. I myself only work a balanced portfolio, I will never make large leaps but then again I am unlikely to lose a lot either.

So in that setting we see:

the Court made interim freezing orders over Mr Merhi’s property. These orders remain in place until 12 December 2025 (25-024MR).

ASIC cancelled the AFSL of FSGA, effective 7 June 2025 and permanently banned its responsible manager (25-102MR).

In July 2025, the Court made travel restraint orders against Mr Merhi. Those orders prevent him from leaving or attempting to leave Australia until 12 December 2025, or until further order of the Court (25-024MR).

That is fair enough I reckon. But now we get to the settings that ABC at the top gave. We see there “In all of these cases, no criminal charges have been laid, but ASIC is heading to court to make allegations against the people at the centre of the Shield and First Guardian funds — those involved in managing and promoting the schemes.” The no criminal charges gives pause to consider that no criminal acts have transpired and when we look at some of the allegations the two that take the cake (a Tiramisu cake) is that the settings of “defective disclosure documents” must be proven and the lawyers will fight that. Then we get “all the circumstances unconscionable” and that is the ballgame, ‘unconscionable’ is not per se illegal and it is about the legality of the matter in court and that is the setting we see. So when I made a statement two years ago saying “Some of their risk and liquidity is in US bonds and when the US forfeits payment your 401K and many other things will become worth close to nothing” we see what bonds were worth 5 years ago. There we see “For the year, long-term U.S. Treasuries were by far the best-performing fixed-income investments, with a nearly 17% gain,” (source: Reuters) at present they are “the 10-year yield settled around 4.36%” that represents a loss of 13%, so who pays for that bond? This was a danger I saw 5 years ago (as uneconomical as I am) and 10 years ago I heard people to buy bonds as the interest is like free money and I stopped. There is no free ride and this is almost pushed into the AI field all whilst there is no verification in place. All settings that are interconnected and we now see the ABC giving us “expose deep flaws in Australia’s $4.3 trillion retirement system” so, what do you think you will end up with because as I see it, there is the chance that these people can do what they like all whilst there is no criminal accountability. Yes, he is stopped for now, but Ferras Merhi is about to walk away with more than $19 million in payments. As such he is willing to sweat it out for a few months. It is a lot more (like 79.2581 times more) than I ever made in my lifetime.

So I see this case that ABC alerted me to with some suspicion. These people live by the setting of walking the edge of legality, there is no risk at that edge and I expect that Ferras Merhi is doing just that not doing anything illegal. As such 12,000 Australians are about to learn that they could lose it all without any illegal actions transpiring and I fault it to two settings (mentioned above) and we all considering setting the clocks to Islam where we see “Islamic banking prohibits the use of interest, speculation, and excessive risk. It emphasizes profit and loss sharing, fairness, honesty, and transparency in financial dealings.” By the way this setting was in place for hundreds of years.

Have a great day and see that Statista gives us “Robusta, named because it can grow at a wider range of altitudes and temperatures, sold for 1.87 U.S. dollars in 2018, projected to sell at 5 U.S. dollars per kilogram in 2026” did you predict in 2018 that you would be setting your retirement to pay 267% for your coffee?